Foreword: I wish solving housing affordability fit into a 30-second TikTok or Instagram reel. It just doesn’t. But if we’re serious about fixing homeownership in America, we need to move past AI-generated graphics, random unresearched ideas, and face some hard truths.

My mother and father taught me to be deferential. As the last child of lower middle-class, dual income parents, entitlement was as foreign to our household as a new car. We were not taught to question authority, but rather to obey it. As I’ve aged, I recognize it’s not only our right but our responsibility to evaluate authority with fairness and consideration. And when the data reveals the outrageous, it’s okay to be outraged. When it comes to housing, we should be outraged.

One of the problems: First-time homebuyers

The recent National Association of Realtors survey from early November painted a sobering picture: first‐time homebuyers now represent just 21 % of all home purchases—a historic low—and their median age has climbed to 40 years old. These aren’t just statistics. They are warning signs that a significant portion of an entire generation is being systematically locked out of the foundational wealth‐building opportunity that defined the American middle class for decades. It further highlights the inherent “sickness” that has been allowed to persist within the largest asset class in the entire world: The United States Housing Market.

Understanding the data—and Its limitations

The NAR survey comes with important caveats. A 120-question survey was mailed to 173,250 recent homebuyers for purchases between July 2024 and June 2025; From those 173,250, came a paltry 6,103 responses—a rate of just 3.5%. If you want to ensure a poor response to your survey, pack it with 120 questions and send it to people who’ve just bought a home.

The architecture of the survey introduces selection bias: people who have strong opinions or unusual experiences are more likely to respond. The data remains important, but it’s unwise to rely upon survey data alone. Just ask anyone who follows Owner’s Equivalent of Rent as a function of inflation.

From my vantage point as CEO of an independent mortgage company with a nationwide lending footprint, we reviewed 6,707 loans of our own, originated January 2023 through November 2025. This is actual data, not a survey. My inner geek was anxious for the results:

- 45.6% of our borrowers were first-time homebuyers, more than double the NAR’s finding.

- FTHB average age: 36.9 years, roughly 3 years lower than NAR.

- FTHB average income: $125,678. This is important as we lend in rural, suburban and urban areas.

- FTHB average DTI: 39.9%.

- FTHB Product mix: Conventional (53.6%), FHA (31.3%), VA (13.6%), Other (1.5%)

On the surface, this seems encouraging: we’re serving first-time buyers at younger ages and at higher percentages than national averages. But these numbers reveal a deeper, more troubling reality about who doesn’t get in the door.

The fatal flaw in current policy

Here’s the problem: only 39% of our first‐time home buyers qualified for Fannie Mae/Freddie Mac’s LLPA exemption, which is restricted to first-time home buyers earning 100% of Area Median Income or less. For those outside the mortgage arena, LLPA’s are loan level price adjustments. They’ve been around since 2008 but have been significantly worsened many times, most recently in January 2023 under the former administration. Fannie Mae and Freddie Mac allow “some” first-time homebuyers to exempt out of these pricing adjustments (think penalties) so long as they don’t make too much money.

According to our data, more than 6 out of 10 first-time buyers—people in their twenties and thirties trying to build their foundation—are paying penalties simply because they earn what many markets now consider middle-class income.

Meanwhile, the federal government sets the conforming loan limit based on resilient home prices, not income. Apple, meet orange. One of these things is not like the other. They acknowledge housing costs have shot up and just increased the limit again to $832,750 for most of the country. But qualification for the LLPA exemption is still based on income, a metric that hasn’t kept pace with housing cost inflation. This mismatch has rendered well-intentioned programs increasingly ineffective, pushing first-time homebuyers out of the market or to FHA financing in greater percentages. More about FHA later.

The numbers don’t lie: The affordability gape widens

This disconnect between wage growth and home-price appreciation is not theoretical, it’s unfolding in real time.

In plain English: Wages are the turtle. Home prices are the hare. On steroids. Since January 2020, home prices have risen +56%. Average hourly earnings? About +28%. In other words, home prices have grown roughly twice as fast as wages since early 2020.

This is why our average first‐time homebuyer is now 37 years old. This is why they need an average income of $125,678 just to compete. And this is why limiting LLPA exemptions to borrowers at 100% AMI is increasingly meaningless. That threshold hasn’t kept pace with what buying a home actually costs.

The generational consequences

When first-time homebuyers don’t enter the market until age 37 or 40, we’re not just delaying homeownership. We are fundamentally altering the trajectory of generational wealth creation. We’re also altering the fabric of how our societies evolve. These buyers:

- have fewer years to build equity before retirement.

- have less time to benefit from appreciation.

- have diminished capacity to pass wealth to the next generation.

- are delaying household formation, impacting everything from consumer spending to birth rates to school enrollments.

We’re not observing a temporary market anomaly. We are bearing witness a fundamental flaw in the American dream. Meanwhile, the current and the past administrations are/were either unwilling or unable to change it.

I’m going with unwilling. Here’s why.

Money: It always comes back to money

Critics might argue that eliminating LLPAs for all first‐time buyers would increase risk or reduce returns for Fannie Mae and Freddie Mac. Our company has not incurred one default from LLPA-exempt first time homebuyers. Lower monthly payments don’t increase risk. They mitigate risk. But reducing pricing penalties and lowering payments reduces returns. And there it is: money. It always comes back to money. In that spirit, consider the following:

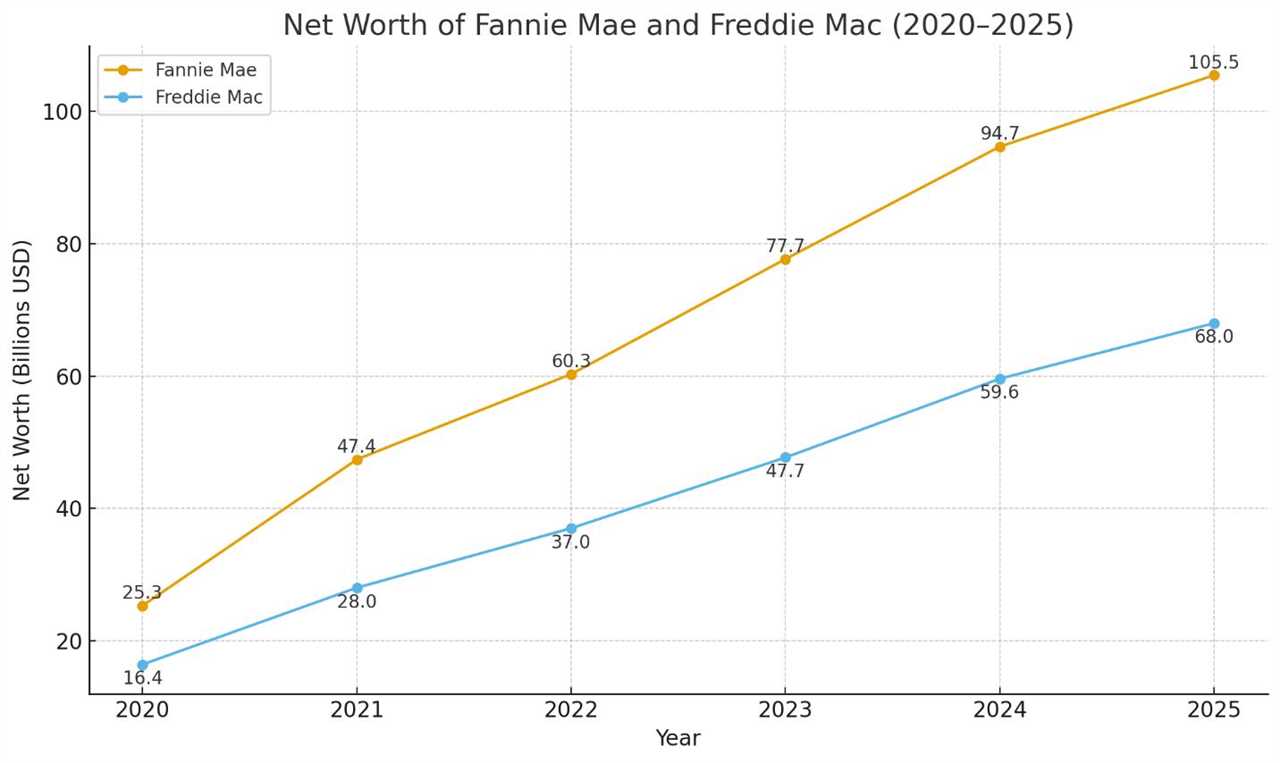

- Fannie Mae reported net income of $17.0 billion for 2024 and $3.9 billion for Q3 2025. Fannie’s net worth is $105.5 billion. At the start of 2022, it was $60.3 billion. Fannie Mae’s net worth has increased 75% in 3 years. Three.

- Freddie Mac reported net income of $11.9 billion for 2024 and $2.8 billion for Q3 2025. Freddie’s net worth is $68 billion. At the start of 2022, it was $37 billion. Freddie Mac’s net worth has risen 84% in the same period. You can swallow now.

Here is a picture of the net worth trajectories for Fannie and Freddie over the most recent 5 years.

Now, here’s a graph of first-time homebuyers as a percentage of all home purchasers in the same time period, followed by a separate graph for average age of first-time homebuyers.

Put another way: In the same three years that Fannie Mae added $45 billion to its balance sheet, the percentage of first-time homebuyers dropped from 34% to 21%. They got richer. The American Dream got smaller.

A clear solution: Eliminate LLPAs for ALL first-time homebuyers

The FHFA should immediately eliminate loan‐level pricing adjustments (LLPAs) for all first‐time homebuyers, regardless of income.

This is not about subsidizing the wealthy. Our data show the average first‐time buyer earning $125,678 isn’t purchasing a luxury estate. They are stretching to afford entry‐level homes in markets where those homes have appreciated far faster than incomes. In many markets, this income barely qualifies as middle class when measured against housing costs.

The current LLPA structure punishes these borrowers with higher costs at the very moment they face the greatest financial stretch to move from renting to owning.

Can FHA save the day?

While certainly an important arrow in the quiver for some first-time homebuyers, FHA has its own share of “profit-over-mission” bias. FHA includes two different mortgage insurance premiums: 1) the upfront premium equivalent to 1.75% of the loan amount and 2) the annual premium (paid monthly), which is un-cancellable, regardless of equity, if the initial home purchase included a down payment of less than 10% (told ya this is tough to put into a reel).

As such, FHA borrowers pay twice to be insured and likely can’t cancel recurring mortgage insurance payments unless they refinance.

Congress stipulates that the FHA maintain a Mutual Mortgage Insurance Fund and that fund must uphold a capital ratio of no less than 2%. Below is a chart from HUD’s own report to Congress, reflecting a capital ratio of greater than five times the Congressional requirement. I’ve been waiting for the most recent report, which was due in November of this year. As of the writing of this article on November 29th, no report has been published, nor is there a timeline for release.

While you’re marinating in that, check this out. As of Q2 2025, the MMI Fund now has a Total Account Balance of $174 billion, a 207% increase since January 2020.

To be fair, FHA did reduce one of its premiums in March 2023. But clearly, that reduction hasn’t impacted their ability to boost net worth and more could/should be done. In fact, since Q2 2023 (after the cut), FHA has amassed an additional $40 billion in net worth. The math isn’t complicated: FHA could cut premiums in half tomorrow, make them cancellable at 20% equity, and still exceed requirements by 150%.

A call to action

FHFA and FHA have the authority today to make changes. No new legislation required. No Congressional approval. No 10-year study period. They don’t need to create AI images for social media, post strange ideas on X with no research or contemplation, or announce bizarre initiatives like altering LLPAs for second homes, 50-year amortizations, or even portable mortgages. All of these have been floated about in the traditional and social media over the past 3 months as “the best ideas” to save housing. Unreal. It would be laughable if it weren’t so insulting.

There are solutions within our grasp. This is but one. We need bold, immediate action to reverse the troubling trends in first-time homebuyer participation. Eliminating LLPAs for all first-time homebuyers and reducing FHA mortgage insurance premiums and terms would:

- reduce upfront cost burdens by thousands of dollars for the buyers who need help most.

- send a clear signal that homeownership remains a viable path for younger Americans.

- align our policies with the economic reality of today’s housing market.

- ensure that “first-time homebuyer” encouragement is more than empty rhetoric.

- help reverse the troubling trend of sellers de-listing their homes at the fastest pace in nearly a decade.

- And, oh yeah, boost volume for Fannie Mae, Freddie Mac and FHA. Isn’t that the point?

We can engage the next generation and restore faith that the American Dream of homeownership remains accessible. The question now – for our leaders and for us – is not a question of capacity. It is a question of will.

Mark Milam is the CEO of Highland Mortgage.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners. To contact the editor responsible for this piece: [email protected].

Read More

By: Mark Milam

Title: The will to solve problems

Sourced From: www.housingwire.com/articles/the-will-to-solve-problems/

Published Date: Tue, 16 Dec 2025 08:32:00 +0000

.png)