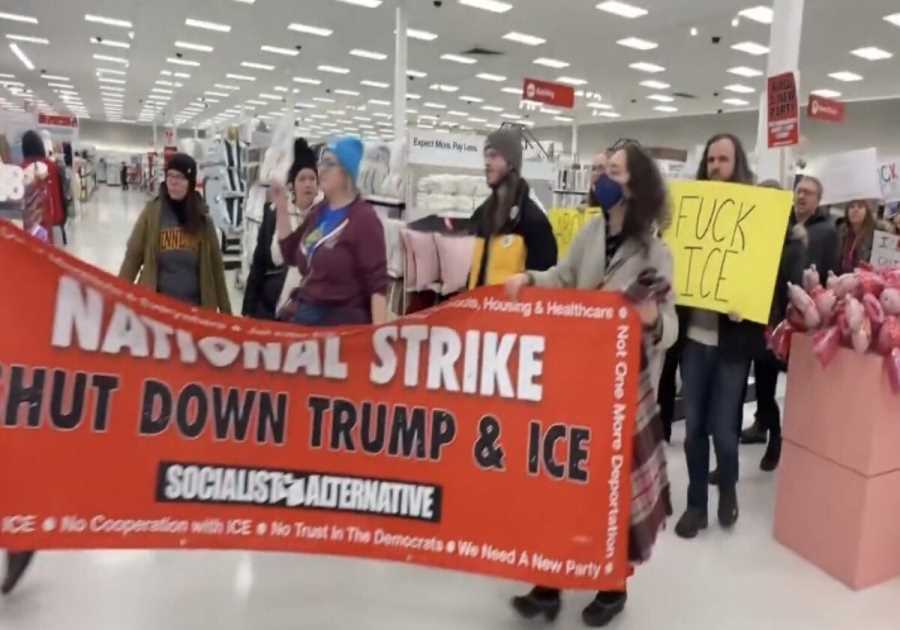

Purchase application data is now below 2008 levels! But I need to explain why this level has more in common with 2014 housing data than the credit stress markets of 2005-2008, and why you should care. Understanding this data line and what it is trying to tell you will be more valuable than erroneously thinking the market is crashing and we’ll see a wave of foreclosures.

In the previous expansion, one of my long-term calls was that the MBA purchase application data will never hit the volume level of 300 until the years 2020-2024. Credit growth in the previous expansion was going to be slow and steady until our household formation data got high enough to get demand higher. Right on cue, 2020 came and we hit the 300 level.

The years 2020-2024 were going to be the time when total home sales could finally reach 6.2 million, something that couldn’t happen from 2008-2019 because we didn’t have the demographic profile to get to that level until household formation grew.

However, the housing market did run into one problem in 2020. Inventory levels broke to all-time lows and thus created massive housing inflation quickly, which broke my model. I knew housing would be OK as long as home prices only grew at 23% over five years — 4.6% nominal per year at most. We are up 43% since 2020.

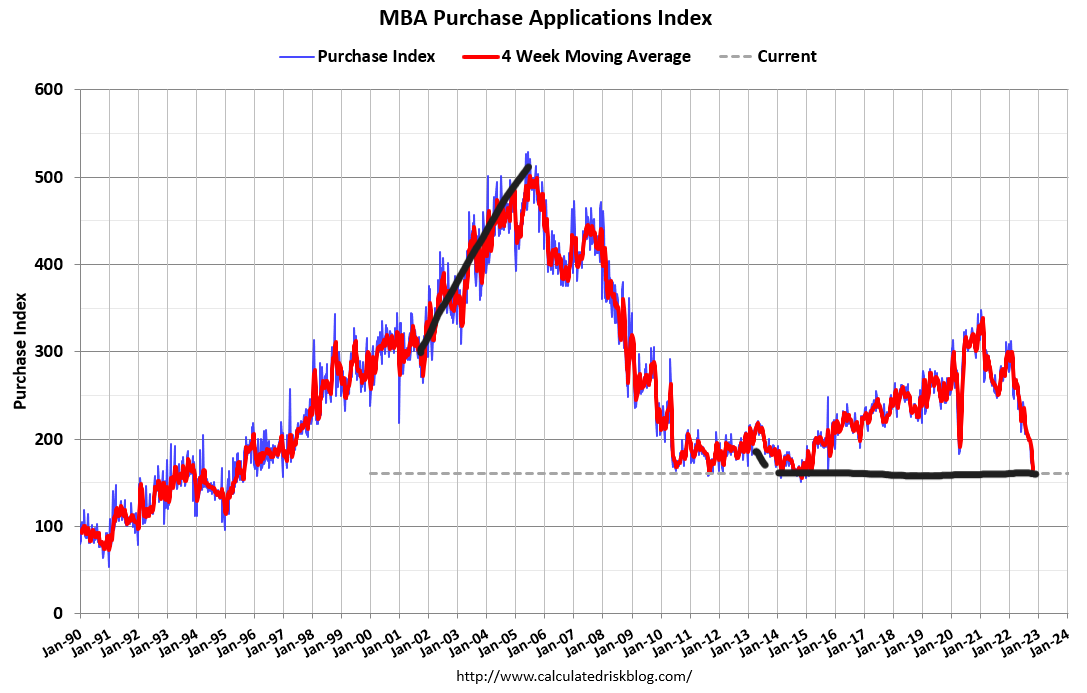

In the summer of 2020, I talked about how the housing market would change, but it needed the 10-year yield to break over 1.94%, which roughly means 4% plus mortgage rates. That happened in March of this year. With the massive housing inflation since 2020 and higher mortgage rates, we are back to familiar territory with existing home sales and purchase application data: we are back to 2014 levels.

Wednesday’s purchase application data was up 1% from week to week. It’s been in a range of -2% – +1 % for some time now, not counting the hurricane week in Florida. The year-over-year data is down 41%, and the four-week moving average is 40.25%.

For some time now, I have been talking about how the year-over-year comps will get challenging starting in October of this year, and this would mean purchase application data will be down 35%-45% during this period; that would be the norm. Since the start of October, the year-over-year declines have been in a range of 39% -42% each week.

The data looks correct. If we had another leg lower in demand, the purchase application data target would be down by 53% to 57%. We haven’t seen that in the data yet.

Looking at the chart below, purchase application data is below 2008 levels today, very close to the lows we saw back in 2014, which, adjusting to population, was the lowest level ever. This time around, we have not seen the kind of housing credit boom that we did from 2002-2005.

Post-2012, whenever mortgage rates rise, existing home sales always trend below 5 million. We saw this happen in 2013-2014 and 2018-2019. However, now with the historical price inflation we have seen since 2020 and the massive increases in mortgage rates since the start of the year, we have the biggest housing affordability hit of our lifetime in a short amount of time.

Purchase application data is back toward 2014 levels, and existing home sales have trended back to 2014. Mortgage rates are higher now than back then, and the price gains are more massive.

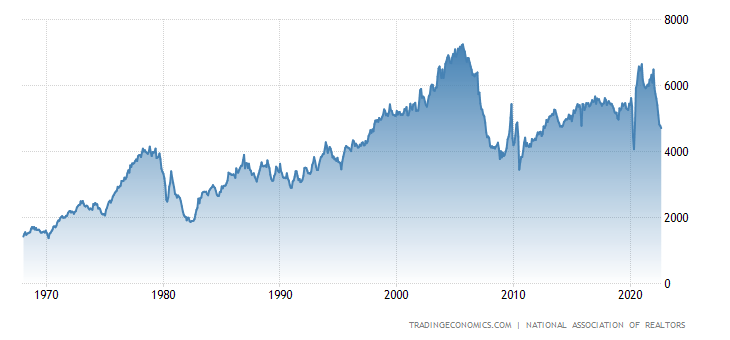

The glaring difference between now and 2014 is that total inventory levels are roughly 1 million lower now than the peak of 2014. Back then, the peak was approximately 2.3 million; today, it’s 1.25 million. Homeowners are in a better financial situation now, they live in their homes longer and longer, so the inventory channels have been much different post-2012.

NAR total inventory data 1,250,000

One thing about purchase application data and demand is that a traditional seller is typically a buyer of a home. Since the end of June, we have seen that the home seller called it quits earlier this year than usual, and now the new listing data is negative year to date. This means less demand for housing.

New listing data is down 5% year to date, as you can imagine. With rates spiking as they did, it isn’t appealing for some people to sell their homes and buy another note. Some people simply can’t move because they can’t afford to.

I still believe this impact on demand isn’t getting the attention it deserves. This occurred at the end of June when the housing recession also started. We haven’t had 12 months of data yet with this reality. New listing data must grow year over year in the spring of 2023, or else the mortgage rate lockdown discussion will get louder.

It’s a first-world problem; homeowners are in perfect financial shape and control of their lives, unlike what we saw from 2005-2008. However, it’s not a good thing for housing demand when new listing data is declining when we started 2022 at the lowest inventory levels ever.

That data looks even worse when adjusting to population and households. Traditionally, inventory levels have been between 2 million to 2.5 million. As we can see, the housing bubble crash was an abnormal historical period, just like what we are dealing with today.

NAR Total Inventory data 1982-2022: Most Recent Report

As we can see, purchase application data is really below 2008 levels, and existing home sales have trended back to 2014 levels, the last time purchase application data was negative. Purchase application data adjusting to population in 2014 was the lowest level ever recorded and we still had over 5 million total home sales back then.

Housing affordability, while not in a crisis before 2020, got into major trouble with price escalation since 2022. This is why affordability and a lack of new listings should be the focus for housing because those two are the real demand hits right now.

It’s rare post-1996 to have existing home sales trends below 4 million. It really only happened in 2008 after a major housing crash and credit dried up. The COVID-19 pause sent sales down to 4 million but we just shot right back up

NAR: Existing Home Sales Currently 4,710,000

Credit isn’t going to dry up as it did from 2005 to 2008, because it’s mostly a 30-year fixed mortgage loan we are providing these days. However, we do need to see new listing growth pick up next year to have a more functional housing market.

However, with the affordability hit we have today with rates over 7% and the lack of new listing growth, meaning fewer sellers who would-be buyers, we can get back down to 4 million and under if these trends continue. The point of this article is to show you the dramatic impact of higher rates and prices and that we need to focus more on the new listing data, which we all should want to increase.

------------Read More

By: Sarah Wheeler

Title: Why purchase application data is below 2008 levels

Sourced From: www.housingwire.com/articles/why-purchase-application-data-is-below-2008-levels/

Published Date: Wed, 09 Nov 2022 20:20:44 +0000

.png)