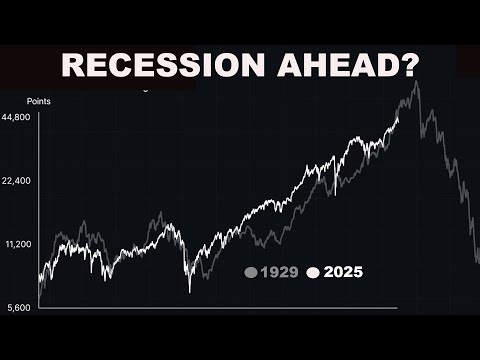

Is the market heading for a breakdown or gearing up for a rebound? In this video, Keith Richards, Portfolio Manager at ValueTrend, dives into the latest technical and sentiment indicators to decode where the S&P 500 might be headed next.

Using tools like the MACD, Bollinger Bands, and stochastics, Keith outlines signs of short-term overbought conditions, while sentiment gauges such as the Put/Call Ratio, Smart Money/Dumb Money Spread, and CNN Fear & Greed Index suggest the market may still have room to run.

Keith also shares his 3-sector action plan, revealing which areas of the market he’s focusing on right now:

1. Defensive plays for short-term protection

2. Energy stocks for potential upside on momentum

3.Technology as a wait-and-watch zone for potential re-entry

He also explores:

Whether a USD bounce is on the horizon

How investor psychology plays into current volatility

Key chart patterns that every investor should watch

Don’t miss this crucial technical update to help shape your short-term trading decisions.

00:00 - Intro: Market Pullback and Key Questions

00:40 - S&P 500 at Support: Breakdown or Bounce?

01:18 - MACD and Momentum Indicators Overview

02:00 - Bollinger Bands and Stochastics Signal

02:30 - Seasonality: July Weakness Explained

03:12 - Short-Term Sentiment: Put/Call Ratio

03:55 - Smart Money vs. Dumb Money Spread

04:30 - CNN Fear & Greed Index Update

05:15 - Is This the Setup for a Market Rebound?

06:00 - U.S. Dollar Analysis: Bottoming Signal?

07:00 - Bearish Implications of a USD Bounce

07:55 - How USD Strength Impacts Equities

08:35 - Market Internals: Breadth and Participation

09:18 - Dow Theory: Transports vs. Industrials

10:10 - Key Signals from Insider Buying

11:00 - Understanding Investor Psychology

11:40 - Contrarian Signals in Action

12:30 - Our 3-Sector Action Plan: Overview

13:10 - Sector #1: Defensive Plays for Stability

14:00 - Sector #2: Energy’s Strength and Setups

15:00 - Sector #3: Tech – Waiting for Confirmation

16:00 - What to Avoid in the Current Market

16:50 - Watching for Reversal Candles and Price Patterns

17:40 - Risk Management Tips for Short-Term Traders

18:25 - Is This a Buy-the-Dip Moment?

19:15 - Summary of Technical and Sentiment Signals

20:00 - Final Thoughts: What We’re Watching Next

20:21 - Outro and Reminder to Subscribe

I am not affiliated with any financial advisers or services promoted in the comments section of this video. Unfortunately, scammers often post fake recommendations or links pretending to offer financial advice. Please DO NOT engage with these accounts, click on their links, or provide them with any personal information. Always verify any financial advice with a trusted, licensed professional.

#StockMarket #Investing #Trading #TechnicalAnalysis #PortfolioManagement #ValueTrend #RiskManagement #InvestingMistakes #TradingStrategy #FinancialEducation #StockMarketTips

Unlock the power of technical analysis and elevate your trading— enroll in our course today and start making smarter investment decisions! https://technical-analysis.valuetrend.ca/

Ready to master technical analysis and thrive in uncertain markets? Get your copy of Sideways today and start navigating market volatility with confidence! https://a.co/d/cUFCm1m

Want to outsmart the crowd and make smarter investment choices? Grab your copy of SMART MONEY, DUMB MONEY now and learn how to profit by going against the grain! https://a.co/d/ieXH59C

Looking to take control of your financial future? Discover the proven 3-step strategy to rebound your portfolio and bounce back stronger than ever. Get your copy of Smartbounce today and start your recovery journey now! https://a.co/d/bAW2uos

Stay ahead of the market trends with our sector analysis and make informed decisions based on historical data and future projections by subscribing to our blog. https://www.valuetrend.ca/blog/

Don't forget to check out our latest performance numbers and see how the ValueTrend Equity Platform can help you preserve capital during market corrections. https://www.valuetrend.ca/equity-plat...

🌐 Connect With Us: [ValueTrend](https://www.valuetrend.ca/)

📧 Contact Us: [[email protected]](mailto:[email protected])

.png)