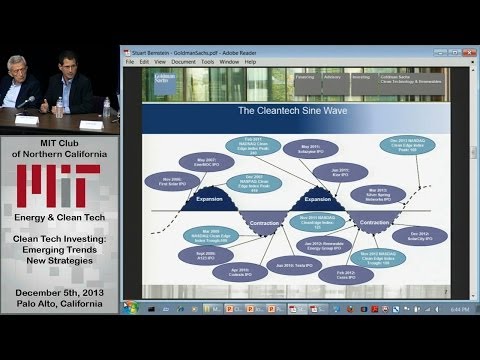

Investors have learned, sometimes bitterly, that the investment life cycle for certain technology and/or manufacturing-based clean technology companies is not the same as software and information technology. Time horizons are longer and usually much more capital investment is required to launch the company.

Consequently, investor priorities have shifted to companies focused on business models that are less capital intensive and deliver more immediate value to customers -- in market segments like efficiency, recovery, recycling and services.

Additionally, many young companies are finding that funding is becoming increasingly more difficult for them. It's no secret that many venture capital firms have left the energy & cleantech space, so some companies are looking to non-traditional investors, such as hedge funds and corporate strategics, to make up the difference.

Please join us on December 5th to hear from some of Silicon Valley's most insightful investors about the changing funding trends in the industry and the new strategies being adopted by both companies and investors alike.

Pierre Lamond -- Khosla Ventures

Scott Jacobs -- EFW Partners

Joel Conkling -- Google.org

Stuart Bernstein -- Goldman Sachs

Moderator: Eric Wesoff -- Chief Editor, Greentech Media

.png)