Good morning, Opening Bell crew. I'm senior reporter Phil Rosen.

As we near the end of 2022, today let's take a moment to count up just how much money some of the wealthiest folks on the planet have lost this year.

If this was forwarded to you, sign up here. Download Insider's app here.

Britta Pedersen-Pool/Getty Images; Arif Hudaverdi Yaman/Getty Images; KENZO TRIBOUILLARD/Getty Images; Mike Cohen/Getty Images; Yuqing Liu/Business Insider

1. As an individual accumulates more wealth, they have more to lose. And between this year's historic inflation, sky-high interest rates, and global economic turmoil, those with the deepest coffers have seen the deepest losses.

Let's start with Elon Musk. His wealth this year has shrunk by $140 billion, bringing his net worth to roughly $130 billion, according to the Bloomberg Billionaires Index.

Then there's Jeff Bezos — the Amazon founder's wealth has gotten $86 billion lighter.

And Microsoft founder Bill Gates saw his fortune tumble by $29 billion, while former CEO Steve Balmer took a $21 billion hit, as Insider's Theron Mohamed points out.

Larry Page and Sergey Brin, the cofounders of Google's parent company Alphabet, together lost roughly $91 billion in 2022.

Perhaps both most notably and most under the radar is how Warren Buffet, the most veteran investor of the bunch, lost a comparatively meager $3 billion.

And of course, FTX's Sam Bankman-Fried saw his net worth evaporate virtually overnight last month, dropping from $16 billion to a buck.

Besides the fallen crypto king, many of these shrinking fortunes can be chalked up to this year's bloodbath in the tech stocks. Amazon has halved in value, Alphabet's down 40%, and Microsoft has tumbled 29%.

(By the way, Buffett's Berkshire Hathaway remains in the green for the year).

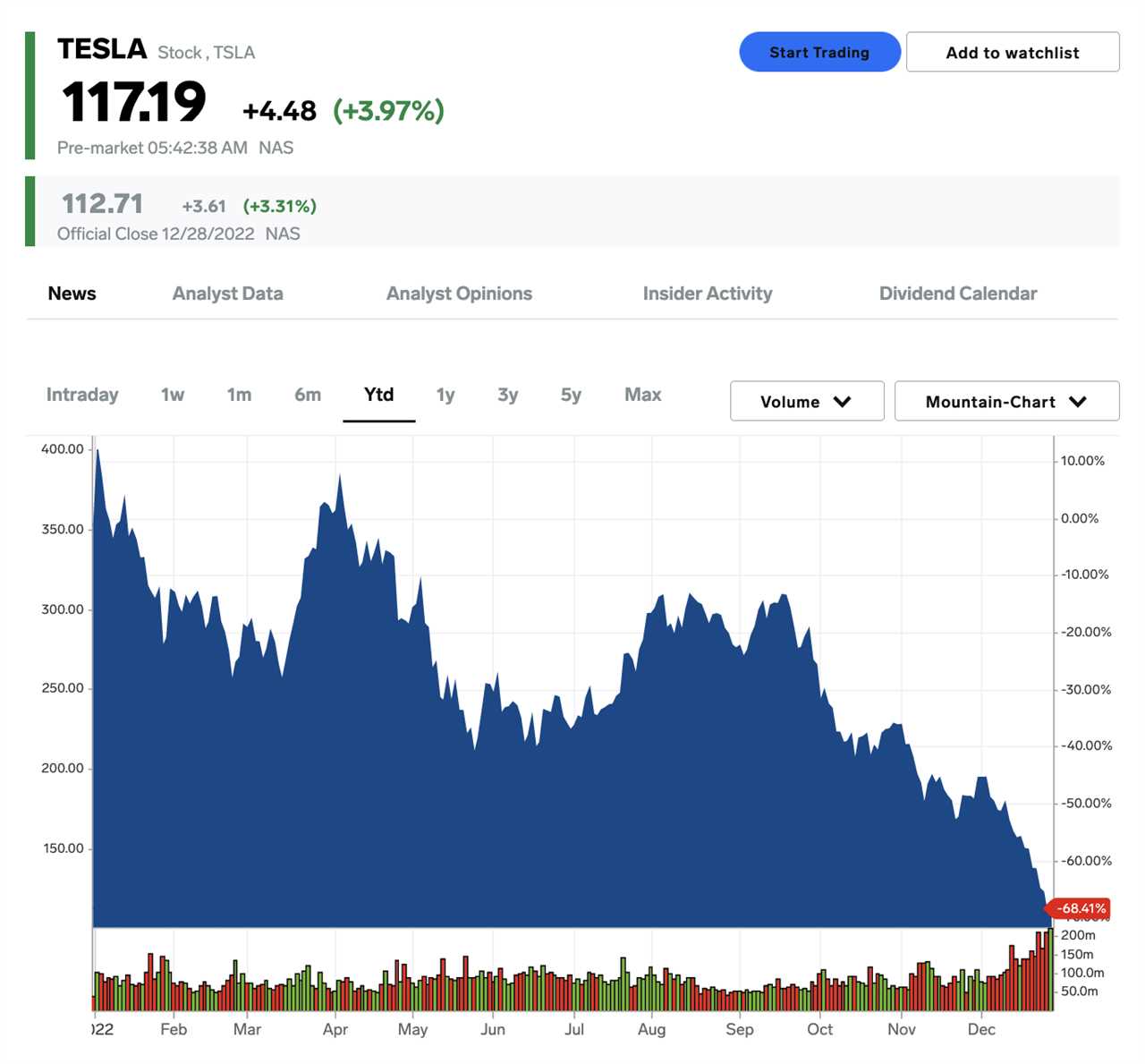

But special consideration should go to Tesla. It remains far and away the dominant player in the burgeoning electric vehicle market, yet its stock has fallen about 68%.

One reason — arguably the reason — is because Tesla the company is synonymous with Musk the individual.

The eccentric executive's involvement with Twitter has tempered the enthusiasm of even some of the most ardent Tesla bulls.

As Wedbush analyst Dan Ives put it: "The Twitter fiasco, opening up the political firestorm on Twitter, and brand deterioration for Musk and Tesla has led to a complete debacle for the stock."

Simply put, Musk's time spent running Twitter (or tweeting) is time spent not running Tesla.

And because some investors see the social media platform as a strain to Musk's bandwidth, Tesla stock has ticked lower — with Musk's net worth in tow.

How has Elon Musk's involvement with Twitter impacted your outlook for Tesla stock? Tweet me (@philrosenn) or email me ([email protected]) to let me know.

In other news:

Jane Rosenberg/Reuters

2. US stock futures rise early Thursday as investors head into the final trading days of the year. Meanwhile, traders are also expecting the latest data on weekly jobless claims later this morning. Here are your morning market moves.

3. Earnings on deck: Hotel Chocolat, Ellomay Capital, and more, all reporting.

4. The founder of Millennial Money achieved financial independence at age 30. He broke down his top investing advice ahead of the new year: "2023 is going to be one of the greatest years to invest."

5. Stocks could surge 20% in the first six months of next year. That's according to Wharton professor Jeremy Siegel. He's looking for the Fed to wrap up its inflation battle and slash interest rates before 2024.

6. Solana, a cryptocurrency that Sam Bankman-Fried heavily supported, has lost nearly all its value. The token once touted as a viable Ethereum rival is down 94% this year. Only months ago, Bankman-Fried himself said it was the most underrated crypto on the market.

7. US prosecutors are probing the possible theft of $370 million in crypto that happened just hours after FTX filed bankruptcy. The investigation is separate from the fraud allegations against Bankman-Fried. The Justice Department has already frozen some funds as part of its probe.

8. Bank of America's stock chief warned that the S&P 500's popularity could be its worst enemy as investors crowd in. The key index has been more volatile lately than traditionally riskier indexes, she said. Here's her strategy for avoiding the tumult in a rocky 2023 market.

9. Bonds look increasingly attractive as equities plummet and recession risks grow. TD Securities' Head of Global Rates Strategy explained how investors can buy into fixed income to maximize returns — and set themselves up for a decade of success.

Markets Insider

10. Tesla stock climbed Wednesday as dip-buyers poured into the EV maker. Elon Musk's company avoided its eighth consecutive session of declines, which would have been its longest slump ever. Get the full details here.

Curated by Phil Rosen in Los Angeles. Feedback or tips? Tweet @philrosenn or email [email protected]

Edited by Jason Ma in Los Angeles and Hallam Bullock (@hallam_bullock) in London.

Read More

By: [email protected] (Phil Rosen)

Title: Crumbling tech stocks and recession fears have cratered the fortunes of the wealthiest Americans including Elon Musk and Jeff Bezos.

Sourced From: www.businessinsider.com/elon-musk-billionaires-wealth-tesla-amazon-warren-buffet-berkshire-microsoft-2022-12

Published Date: Thu, 29 Dec 2022 11:00:00 +0000

.png)