Happy Friday to my favorite corner of the internet. Senior reporter Phil Rosen here one last time before the weekend. If you didn't check your portfolios yesterday, take a peek now if you want to feel like Christmas came early.

The stock market just had its best day of the year. We can chalk that up to the Thursday morning inflation data that showed prices cooled faster than expected in October.

I'm not one to celebrate prices being 7.7% higher than a year ago, but that's certainly better than the 8.2% inflation we saw in September.

Turns out those Fed's interest rate hikes might just be working, at least a little bit — and investors are celebrating.

If this was forwarded to you, sign up here. Download Insider's app here.

REUTERS/Brendan McDermid

1. As far as a single day is concerned, yesterday looked like a perfect storm for the stock market. Between lower-than-expected inflation print and a gridlocked political arena, investors poured in.

The Nasdaq saw a more than 6% gain, the S&P 500 climbed more than 4.6%, and the Dow jumped over 3%.

Meanwhile, the yield on the 10-year Treasury, which has been flashing recession signals in recent months, plunged after the morning's inflation report.

That didn't surprise JPMorgan, as the firm's analysts earlier this week had projected a rally in markets and an easing of bond yields following a cool inflation report.

With CPI posting a fairly meaningful decline, the likelihood the Federal Reserve eases the pace of its rate hikes has climbed. The Fed has made four consecutive 75-basis-point hikes, but now traders are pricing in higher odds of a 50-basis-point move in December.

On Thursday, the CME FedWatch tool showed roughly a 80% probability for a half-point hike, up from 58% earlier this week.

"Investors got a really nice beat on CPI this morning driven by goods 'deflation' and medical costs; markets are reacting strongly in kind," Cliff Hodge, chief investment officer at Cornerstone Wealth, wrote in a note. "There's no question this release is a welcome sight at the Fed, which now have room to step down the pace of hikes to 50 basis points in December and potentially less in 1Q."

According to Nobel economist Paul Krugman, the drop in inflation means a soft landing for the economy is increasingly plausible.

"A good inflation report," he wrote in a tweet. "Monthly data are volatile; still 6% over the past 3 months. But shelter accounts for more than half of that – and [it's] a lagging indicator," he said.

And for Wharton professor Jeremy Siegel, the Thursday data shows inflation is "basically over," and stocks are set up for a strong rally into year-end.

In his words: "We're in negative inflation mode if the Fed uses the right statistics, not the faulty statistics that they've been using."

Does the latest inflation report change your outlook on the economy or predictions for what the Fed will do next?

Let me know on Twitter (@philrosenn) or email me ([email protected]).

In other news:

(Photo by Jabin Botsford/The Washington Post via Getty Images)

2. US stock futures rise early Friday, after Thursday's CPI print showed inflation cooled in October. Meanwhile, crypto lender BlockFi suspended withdrawals, blaming the uncertainty around FTX's implosion. Here are the latest market moves.

3. Earnings on deck: Softbank Corp., Olympus Corp., and more, all reporting.

4. A real estate investor shared a "once in a lifetime" buying opportunity that's bigger than 2008. He currently owns 109 properties, and explained how to buy property without your own money, and how to navigate a high-interest-rate environment. Here are his five tips to take advantage of a coming 20% market correction.

5. SEC chairman Gary Gensler said crypto is a "significantly non-compliant" market and investors need better protections. He told CNBC that the digital asset sector still has regulations, and those regulations are clear. Gensler's comments come as the SEC and the Commodity Futures Trading Commission are investigating FTX.

6. European gas prices have cratered 60% from their summer peak. Warm weather is boosting stores of natural gas, but households are still feeling the pressure of soaring energy costs. Get the full details.

7. FTX's Sam Bankman-Fried broke his silence yesterday, days after the dramatic collapse of his crypto exchange. "When it rains, it pours," the 30-year-old wrote as part of a long series of tweets. He made key comments about customer withdrawals, leveraged assets, and more: "My hands were tied."

8. These three "megatrends" will help investors get the income they need and profit from inflation. That's according to Franklin Templeton, who managed nearly $1.3 trillion in assets as of September 30. The firm's experts discussed how investors can reduce their downside right now.

9. A top JPMorgan analyst explained why it's time to buy into small- and mid-cap stocks. Amid recession fears and aggressive monetary tightening, Eduardo Lecubarri said the medium-to-long term outlook for this batch of companies has "never looked stronger." He broke down his bullish case with four reasons.

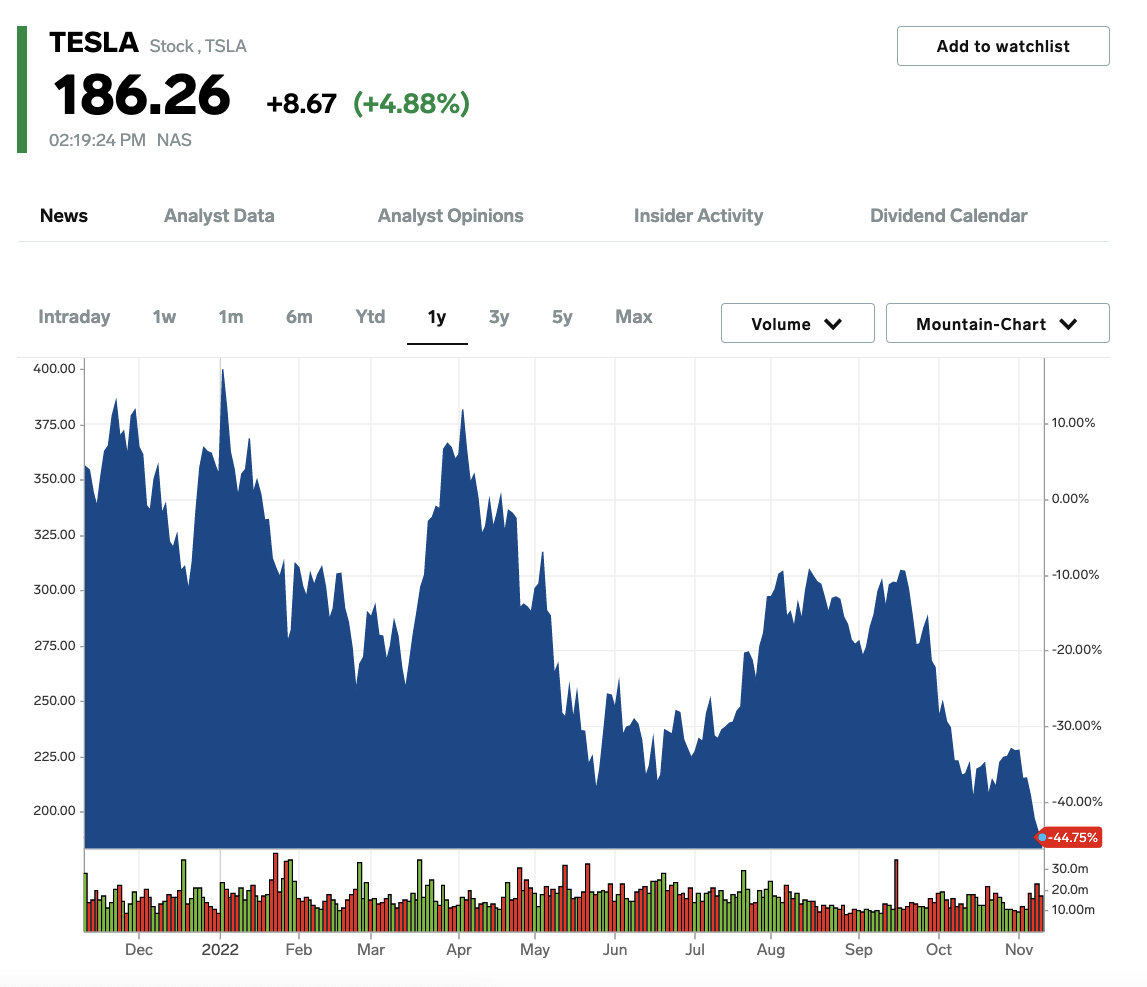

Markets Insider

10. Wedbush booted Tesla from its "Best Ideas" list as the stock has been hurt by Elon Musk's ongoing Twitter drama. The "circus show" brought forth by the billionaire is starting to impact the EV maker's pristine brand, analyst Dan Ives wrote in a note. Shares of Tesla have shed roughly 15% since Musk completed his $44 billion purchase of Twitter.

Keep up with the latest markets news throughout your day by checking out The Refresh from Insider, a dynamic audio news brief from the Insider newsroom. Listen here.

Curated by Phil Rosen in New York. Feedback or tips? Tweet @philrosenn or email [email protected]

Edited by Max Adams (@maxradams) in New York and Hallam Bullock (@hallam_bullock) in London.

Read More

By: [email protected] (Phil Rosen)

Title: Inflation is getting less hot - and the best-case scenario for stocks just played out.

Sourced From: www.businessinsider.com/economy-stock-market-outlook-cpi-fed-interest-rate-hike-inflation-2022-11

Published Date: Fri, 11 Nov 2022 11:15:00 +0000

Did you miss our previous article...

https://trendinginbusiness.business/business/republican-rep-young-kim-faces-off-against-democrat-asif-mahmood-in-californias-40th-congressional-district-election

.png)