Hollis Johnson/Insider

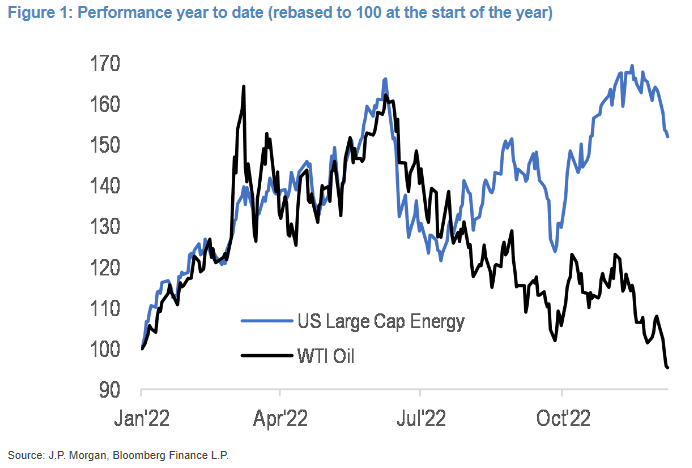

- A tactical trade in energy stocks is shaping up after oil prices have erased all of their 2022 gains.

- JPMorgan recommends investors sell energy stocks to capitalize on the performance divergence between oil and energy stocks.

- "The catalyst for convergence would be a pullback in the broad equity market," Kolanovic said.

JPMorgan's Marko Kolanovic is recommending investors ring the register on the stock market's most profitable trade in 2022: energy stocks.

In a Thursday note, Kolanovic said recent performance divergences between energy stocks and oil prices offers an opportunity for a tactical trade to sell energy stocks.

After surging more 72% in the early-days of the Russia-Ukraine war, oil prices have plunged nearly 50% and are now showing losses for 2022. The ongoing decline in WTI and Brent Crude Oil can be seen in the average price for a gallon of gas in America, which fell to $3.32 on Friday after topping $5 earlier this year.

Yet while oil prices have plunged, oil stocks have remained resilient and are still trading near multi-year highs. The Energy sector is up more than 50% year-to-date, and some oil giants like Chevron and Exxon Mobil are trading near record highs.

But historically, oil prices and energy stocks have been tightly correlated, and given the big performance divergence that has occurred over the past few months, something has to give, according to Kolanovic.

"With oil being close to flat for the year, and the energy segment up ~60%, we believe that there is a tactical trade to sell energy stocks," Kolanovic said. The market strategist expects a broader sell-off in the stock market to be the catalyst that will spark a downside move in energy stocks.

"The catalyst for convergence would be a pullback in the broad equity market," Kolanovic said, before adding that this is a short-term trade that could ultimately offer a new buying opportunity for investors.

"This is a tactical short-term call, and, given that longer term we still believe in the energy supercycle and broad market recovery after a Fed pivot, a significant pullback in energy stocks would present a great entry point, in our view," Kolanovic said.

Kolanovic believes a pull back in oil stocks could be as much as 20%-30%, which would put the energy sector back to levels it saw at the start of 2022, before its big upswing.

JPMorgan

Read More

By: [email protected] (Matthew Fox)

Title: JPMorgan's quant guru says it's time to sell energy stocks as massive outperformance relative to oil prices isn't likely to last

Sourced From: markets.businessinsider.com/news/stocks/sell-energy-stocks-oil-price-divergence-outperformance-jpmorgan-marko-kolanovic-2022-12

Published Date: Fri, 09 Dec 2022 14:57:48 +0000

Did you miss our previous article...

https://trendinginbusiness.business/business/chelsea-reportedly-loses-25-million-crypto-sponsorship-deal-as-ftxs-collapse-hammers-other-platforms

.png)