Reuters / John Gress

- Markets have rallied this year, but the US is still facing a significant risk of recession, Capital Economics warned.

- That's because financial conditions are the tightest they've been since 2008.

- Warning signs of a downturn have emerged in the credit market and money supply data.

Thee US is still on the precipice of a recession despite stocks rallying this year amid forecasts of a soft landing, and according to a note from Capital Economics on Thursday, the economy is under the most pressure since the Great Financial Crisis in 2008.

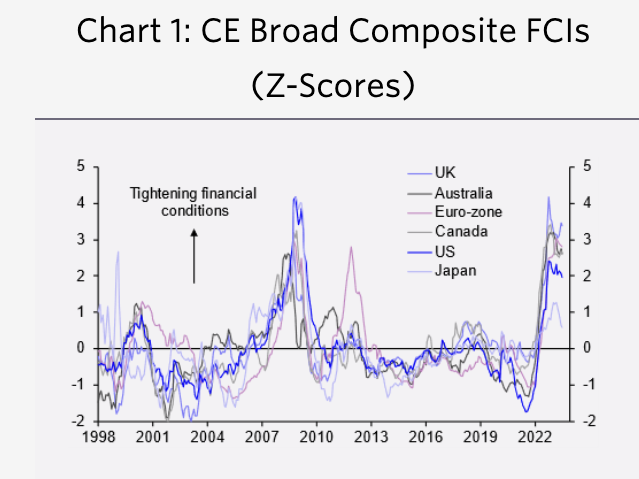

The research firm pointed to extremely tight financial conditions after the Federal Reserve aggressively hiked interest rates over the past year, raising its target interest rate to its highest range since 2001.

That's led to the tightest financial conditions since 2008, the firm said, pointing to financial condition indexes, or FCIs, which show financial conditions in US, Europe, Australia, Canada, and Japan nearing Great Recession levels.

Capital Economics

Warning signs of a downturn have also begun to emerge in the credit market. Interest rates on consumer credit have spiked past 8%, which is one of the largest drivers of tight financial conditions, the firm said.

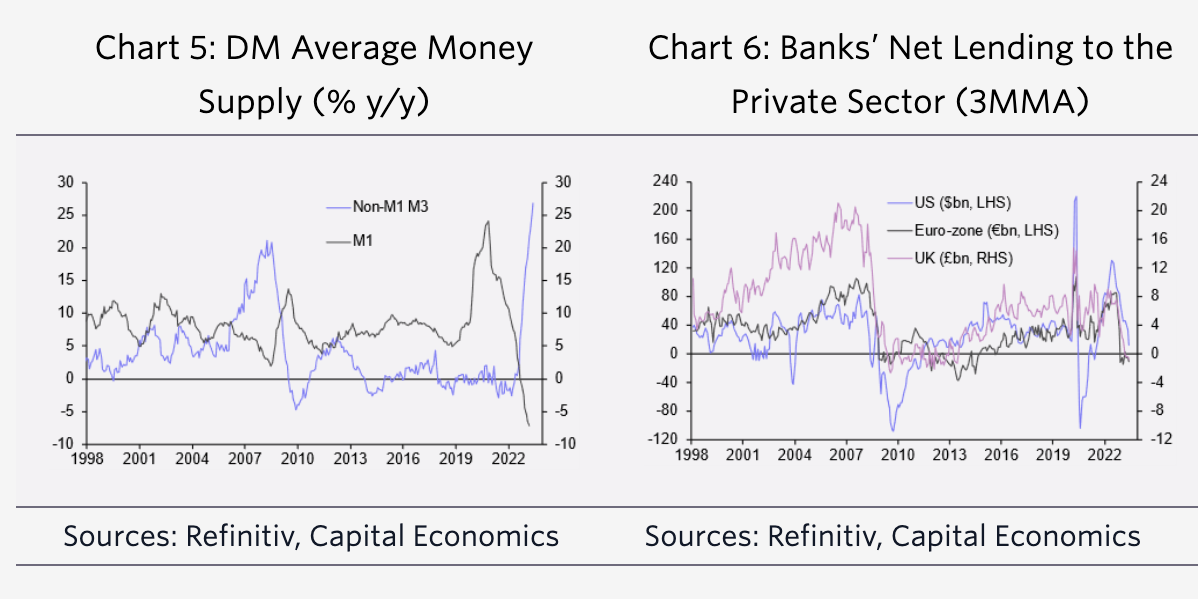

Meanwhile, banks have pulled back on lending significantly, with net lending to the private sector slowing to a near-standstill. Money supply growth has also slowed, another major sign the economy is slowing down.

Capital Economics

"All in all, whether it is our FCIs, the money and credit data, or the bank lending surveys, the financial conditions data all point towards economic activity in advanced economies struggling in the quarters ahead," Capital Economics senior global economist Simon MacAdam said in a note on Wednesday. "In the absence of significant offsetting factors, recessions seem more likely than not in most cases."

That's contrary to what some investors are expecting, as markets have warmed up to the possibility of a soft-landing in recent months. The labor market has remained resilient despite the Fed's rate increases, but interest rate hikes have a lagged effect on the economy, economists warn, meaning there's still downside risk ahead for jobs and other areas of the economy.

The New York Fed has predicted the US has a 66% chance of tipping into a recession by July 2024, though signs of a slowdown haven't yet shown up in economic data. GDP accelerated 2% over the first and second quarters, and Atlanta Fed economists are expecting the economy to expand 3.9% year-per-year over the third quarter. That's trending in the opposite direction of a recession, which is technically defined as two straight quarters of negative GDP.

Read More

By: [email protected] (Jennifer Sor)

Title: Markets may be on a tear this year, but the economy is under the most pressure since 2008 and could still easily fall into recession, research firm says

Sourced From: www.businessinsider.com/recession-warning-prediction-us-economic-outlook-2008-financial-crisis-fed-2023-8

Published Date: Thu, 10 Aug 2023 14:10:44 +0000

Did you miss our previous article...

https://trendinginbusiness.business/business/highpowered-satellites-have-made-bluecarbon-credits-a-reality-but-they-still-face-accuracy-and-scalability-issues

.png)