XBRL errors can significantly impact the accuracy and reliability of your organization’s financial reports. Ensuring that these errors are minimized and avoided is crucial for maintaining the integrity of financial data and for compliance with regulatory requirements.

The SEC is paying close attention to the quality of your company’s XBRL tagging, making it critical to avoid common mistakes. According to a study conducted by XBRL US, many common (and preventable) XBRL errors are still submitted each year, come filing time. In this article, we will explore the four most common XBRL mistakes, examples of each, and how to avoid/prevent them in the future.

Key Takeaways:

- XBRL (eXtensible Business Reporting Language) errors come from mis-tagged, poorly formatted, or incorrectly presented financial data.

- These issues can interfere with financial reporting and interpretation, result in SEC scrutiny, and reduce stakeholder trust in your disclosures.

- The most common types of XBRL errors include Invalid Member-Axis Combinations, Negative Value Errors, Required Value Not Reported, and Date Errors.

- The most important ways to prevent and mitigate XBRL errors include training your staff on XBRL standards, taxonomy changes, etc., reviewing existing taxonomies, collaborating across teams, and using validation tools.

- Certent Disclosure Management provides validation tools and other ways to automate XBRL tagging, centralize review and collaboration, and simultaneously ensure accuracy, compliance, and efficiency.

What Are XBRL Errors?

XBRL errors are caused by inaccuracies or issues in the tagging, formatting, or data presentation within an XBRL (eXtensible Business Reporting Language) report. These errors can result from factors like incorrect taxonomy selections, misaligned data tags, or syntax errors within the report. These easily overlooked mistakes can lead to significant misinterpretations of financial data, potentially causing compliance issues, hampering strategic decision-making, and reducing the transparency of financial reporting. Identifying and correcting these errors is essential to ensure that financial information is accurately communicated to stakeholders and regulators.

XBRL Tagging Challenges

Although hugely beneficial (accuracy, transparency, comparability, etc.), XBRL tagging presents several significant challenges due to its complexity. The process demands a high level of precision, with even small errors in tagging creating significant issues in your financial reporting. Furthermore, the dynamic nature of financial data and frequent updates to XBRL taxonomies make it difficult for organizations to keep their tagging consistent and up to date (especially for teams that perform this process manually). Some major challenges of XBRL tagging that can produce errors include:

- Taxonomy Selection: One of the primary challenges is selecting the correct taxonomy elements from a vast array of available tags. With so many options, it’s easy to inadvertently choose a tag that is close, but not entirely accurate — which often leads to potential misrepresentation of data.

- Consistency Across Reports: Ensuring consistency in tagging across different reports is another core challenge, especially when you make updates to taxonomies. These changes can complicate the tagging process and increase the likelihood of consistency-based errors.

- Resource-Intensive Validation: Organizations need detailed validation processes to catch syntax errors and incorrect tag combinations, which adds another layer of difficulty. This can be resource-intensive, making it challenging for organizations to maintain both accuracy and efficiency in their XBRL reporting.

Overcoming these challenges requires a deep understanding of XBRL standards, continuous training, and the implementation of modern disclosure management tools (like Certent Disclosure Management) that can automate and streamline aspects of XBRL tagging and validation.

Summary: Most Common XBRL Errors

Below, we’re going to go into technical detail about each of these errors, but let’s start with a high-level overview first:

| Error | Explanation & How to Prevent |

| Invalid Member-Axis Combinations | Tags where a dimension axis is paired with a member that doesn’t logically belong. Use validation tools early in the process to catch invalid combinations. |

| Negative Value Errors | Values tagged as negative when they should be positive (or vice-versa) according to the definition of the concept. Ensure that your team understands one-way and two-way elements and when a sign reversal is needed. |

| Required Value Not Reported | Required concept missing from the instance document. Maintain a checklist of required elements that must always be present and verify this near the end of the tagging process. |

| Date Errors | Fact tagged with a date outside the permissible period for the concept. Map each concept to the appropriate context type and ensure the dates reflect the reporting period end or the appropriate date defined in the taxonomy. |

3 Keys for Successful XBRL Filing

Download NowXBRL Error #1: Invalid Member-Axis Combinations

Accounting for over one-third of errors identified by XBRL US, the invalid axis member combination is easily the most common XBRL error. This is a qualitative error that occurs when a member and axis are used together in a way that doesn’t make “financial sense.” With the number of axes and members in the US GAAP Taxonomy, there are almost endless possibilities for incorrect combinations.

Invalid Member Axis Combinations Example 1:

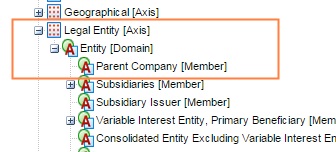

The offense that occurs most frequently is the incorrect use of ParentMember under LegalEntityAxis. The intention of ParentMember and its home axis, EquityComponentsMember, is to identify the portion of equity that is attributable to the parent (in other words, excluding non-controlling interests). When filers place ParentMember under LegalEntityAxis, they combine equity reporting and legal entity concepts, which does not make sense in financial terms.

LegalEntityAxis should only be used with its intended member, ParentCompanyMember, which, by definition, is intended for the legal entity acting as a parent of a company in a parent/subsidiary relationship.

Some errors may be obvious when reviewing a company taxonomy, such as an asset type member housed under a liability type axis. However, others may require a more detailed analysis (as seen in the following example).

Invalid Member Axis Combinations Example 2:

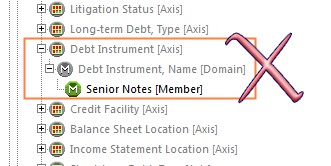

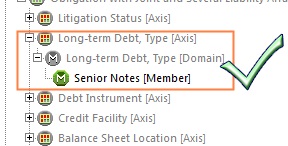

You may be reviewing your taxonomy and see SeniorNotesMember (a standard US-GAAP element) under DebtInstrumentAxis and think that this is an appropriate combination. However, XBRL US disagrees.

They advise against using any non-extended member in combination with DebtInstrumentAxis. The reason is that this specific axis is intended for the name of company-specific debt instruments (as indicated by the associated domain DebtInstrumentNameDomain). In this situation, the appropriate action would be to investigate the tag to determine whether a replacement is needed for the member (which would be an extension) or the axis (which would be a more appropriate axis of either LongTermDebtTypeAxis or ShortTermDebtTypeAxis).

As we saw in the first example, invalid combinations won’t necessarily be obvious to the average user. It is important to carefully consider the member axis combinations by asking yourself the following questions (keeping in mind the overall goal of making financial sense out of the data):

- Is the member appropriate for the concept being tagged?

- Is the axis appropriate for the concept being tagged?

- Are the axis and member appropriate for each other?

- Is there a more accurate member/axis available in the taxonomy?

Filing with this type of error leaves inaccurate and potentially misleading data for public consumption and can be easily prevented. Consider incorporating some of the following preventative and corrective steps into your process.

- Training: If your internal reporting staff is responsible for element selection, make sure they are properly trained to analyze member axis combinations for appropriateness.

- Review New Taxonomy Items: Implement a review process for new member/axis/element selection. With the vast array of members and axes that are available in the taxonomy, two heads really are better than one at identifying those easy-to-miss member-axis combination errors.

- Review Existing Company Taxonomy: When you have some downtime between filings (which modern tools should enable), take some time to review your existing taxonomy structure for its appropriateness. If you wait until crunch time in your filing schedule, it is more likely to get pushed aside for next quarter.

- Validation: There are several validation tools out there that will identify this type of error (among other issues) and summarize them in a report, which can then be addressed using the proper reporting narrative. Through insightsoftware’s partnership with XBRL US, this validation can be easily completed in our Certent Disclosure Management platform.

The quality of your XBRL tagging speaks volumes about your company’s financial disclosures. A disclosure management platform like Certent can help you avoid these errors with a series of validation warnings (plus automating a variety of other processes).

CDM Product Roadmap: What’s Ahead

Download NowXBRL Error #2: Negative Value Errors

The negative value error is the second most common error committed by filers and accounts for over 12% of all XBRL errors. Essentially, this error occurs when a concept reported as a negative value is expected to have a positive value. According to XBRL US, certain concepts should only have negative values in exceptional circumstances. Thankfully, a validation tool is a great way to check for this type of error. However, with over 15,000 elements in the taxonomy and numerous unique company disclosures, it is important to review your negative values internally as an additional line of defense.

In order to perform a negative value check, you will need to filter by instance document values. In Certent’s Disclosure Management platform, you can quickly pull up all negative instance document values and navigate directly to their location in the document with a click of your mouse. Once you’ve identified the negative values in your document, it is critical to understand why it was reported as negative so you can make any appropriate corrections to the underlying logic.

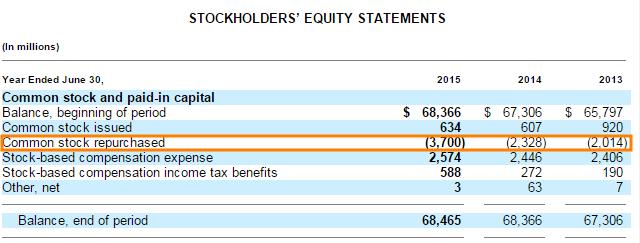

Negative Value Errors Example 1: Reverse Sign and/or Negate Label

There are certain situations in which a change will always have a negative effect. For example, the repurchase of common stock will always reduce shareholders’ equity. Because of this, the element TreasuryStockValueAcquiredCostMethod (which would typically be applied to this concept/line item) has a balance type of debit in the US GAAP taxonomy. When this element is applied without being negated, a negative value error is created. Another example of a concept that is susceptible to negative value errors is treasury stock. Stock repurchases have a negative effect on shareholders’ equity and are presented in the equity statement in parentheses (as shown in the image below).

Image Caption: Microsoft Corporation 2015 10-K

If TreasuryStockValueAcquiredCostMethod is applied to this line with a standard label role, the balance type of the element (debit) combined with the negative presentation gives us a negative debit (i.e. a credit), which is incorrect for a concept that reduces equity. Therefore, this particular element should have a reverse sign and a negated label applied. Reversing the sign changes a value to the opposite sign in the instance document (i.e. negative to a positive or positive to a negative). Once the instance document value is positive, it will also show as positive in the XBRL rendering. This needs to be corrected by changing the preferred label role in the company taxonomy to NegatedLabel, which will cause the values tagged with the negated label to be presented as the opposite sign.

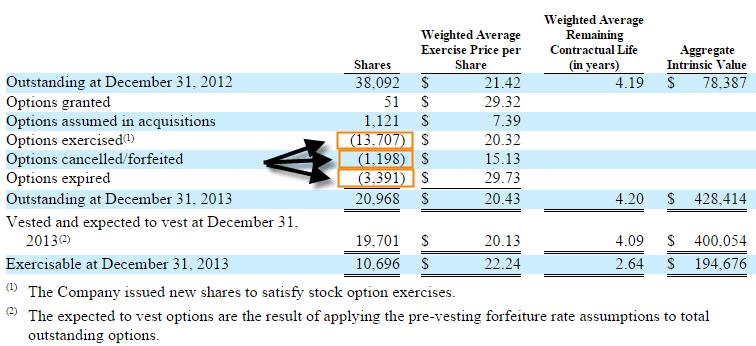

Another example of a common area that requires a reversed sign and a negated label is a standard stock option activity roll-forward table. In this standard disclosure, exercised, cancelled, and expired shares are typically presented as negative values because they reduce the number of options available for grant. However, it isn’t possible for a negative number of shares to be exercised, cancelled, or expired. As a result, these concepts also require reversed signs and negated label roles. SEC XBRL Staff Observations identify additional examples of concepts that should only have positive values.

Image Caption: Yahoo! Inc. 2013 Form 10-K

Negative Value Errors Example 2: Incorrect Element Use

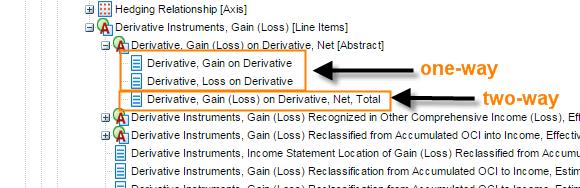

There are two types of elements in the taxonomy when negative value errors are being discussed:

- One-way elements are intended to capture a one-way change in a concept (e.g. a derivative gain).

- Two-way elements capture both increases and decreases (e.g. gains and losses on derivatives).

It’s important to make the proper element selection for your company’s individual situation. If a concept in your document will almost always have the same balance type (and therefore almost always be presented as either positive or negative, but not both), it is better to choose the element with the narrower definition. However, if the balance type of the concept fluctuates between debit and credit, it would be more appropriate to use a two-way element. If you come across a negative value associated with a one-way element in your review, you may want to consider replacing it with an element that is more specific to the concept being disclosed.

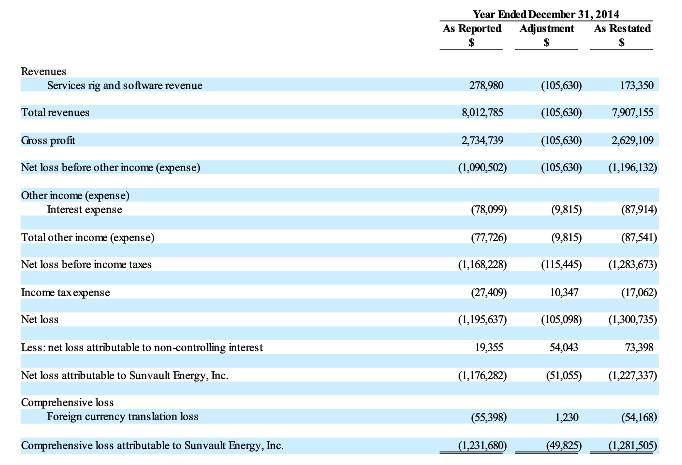

Negative Value Errors Example 3: Dimensional Qualification (Members)

The next type of negative value error is related to missing dimensional tags or members. Sometimes there are legitimate reasons to have a negative value for a concept that is expected to be positive, such as accounting adjustments and inter-company eliminations. The structure of the taxonomy of these types of disclosures generally provides for the use of members such as RestatementAdjustmentMember and ConsolidationEliminationsMember. These types of members allow concepts that typically should be positive to be negative, without causing errors. Some other members that can indicate reductions in otherwise positive values may include text such as “reconciliation,” “netting,” and “adjustment.”

XBRL Error #3: Required Value Not Reported

As the third most common XBRL error, required value not reported accounts for nearly 10% of XBRL errors. This occurs when a required value or a combination of values is not reported as a fact(s) in the instance document. The missing required elements that cause this type of error consist of common concepts that are either explicitly defined in the US GAAP taxonomy, Accounting Standards Codification (such as earnings per share), or elements in the US-GAAP taxonomy that are defined generically (such as Assets). It can be difficult to identify missing concepts in the sea of values that make up financial statements, so this error is best prevented by using a validation tool like Certent Disclosure Management.

A required value not reported error indicates that certain concepts or other necessary elements (e.g. earnings per share) are not reported in the instance document. Unless you are a non-public company that isn’t required to report earnings per share, a missing earnings per share fact indicates incorrect XBRL reporting. Usually, earnings per share data is missing because the concept was tagged with a custom element extension. However, since the Accounting Standards Codification explicitly defines this concept, the company’s disclosure of earnings per share will almost always be consistent with the element provided in the US GAAP taxonomy. Another example of an inappropriate custom element extension would be the extension of an assets element. The US GAAP taxonomy defines this element generically to avoid unnecessary extensions.

In addition to unnecessary extensions, the required value not reported error is caused by inappropriate US GAAP element selection. The most frequent error related to missing required information occurs on the Cash Flow Statement, which we’ll discuss next.

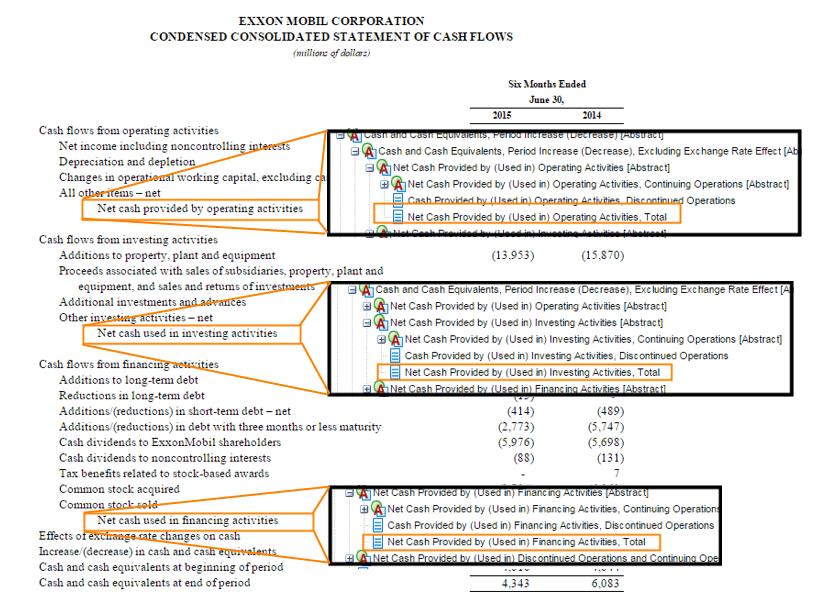

Required Value Not Reported Example 1: Cash Flow Statement

In the Cash Flow Statement of Exxon Mobil Corporation below (which does not represent their actual element selection), it may appear that the elements selected for the total of the operating, investing, and financing activities sections are correct. After all, the selected elements appear to be the given total elements. Nevertheless, a closer look at the structure of the taxonomy is required.

Image Caption: Exxon Mobil Corporation 2015 10-Q

The definition of all three selected elements indicates that discontinued operations are included in the calculation. However, since no discontinued operations exist in this statement, the selected elements are inappropriate. The actual error that results from this incorrect element selection is the missing Continuing Operations and Discontinued Operations elements that are expected to be included with an element that is defined as the total of both. XBRL US provides best practice guidance, which includes additional information and recommendations on this cash flow statement issue.

This error does not just occur during a taxonomy build — it also occurs when circumstances change, but the associated elements do not. For example, Accounting Standards Update number 2014-08, issued in April 2014, changed the criteria for reporting discontinued operations. This modification caused a number of filers to reclassify disposals from discontinued operations to continuing operations. If all discontinued operations were completely reclassified and the operating, investing, and financing activities total elements were not updated, then the result is incorrectly reported concepts and a required value not reported error.

Streamline Your Financial Year-End Close Process

Download NowXBRL Error #4: Date Errors

According to XBRL US, date errors are the fourth most common XBRL error committed by filers and account for almost 10% of all errors. These are caused when concepts in an XBRL document are tagged with incorrect dates in relation to the end date of the reporting period. The date error can also pop up when a concept is tagged with the appropriate calendar, but has not been properly dimensionalized. With proper training and a thorough review process, this error can be easily avoided.

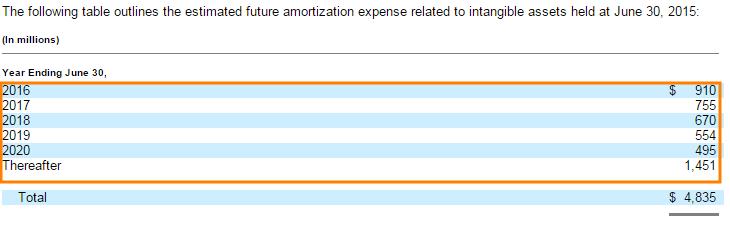

Date Error Example 1: Future Amortization Expense

Below is an excerpt from Microsoft Corporation’s 2015 10-K “Goodwill and Other Intangible Assets” note. Since future dates are stated in this disclosure, one might be inclined to tag each line with the associated fiscal year calendar. Yet, that would be inappropriate because this table consists of an estimate at the reporting period end of future expenses, not an exact amount.

Image Caption: Microsoft Corporation 2015 10-K

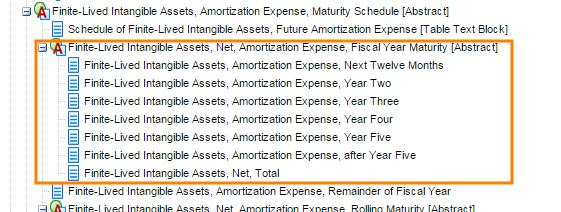

The US GAAP taxonomy contains “future” elements that indicate the associated concept as an estimate of a future recognition. If this type of element exists in the taxonomy for a particular concept, the appropriate treatment is to use a date context of the end of the reporting period of the document.

Image Caption: 2015 US GAAP Taxonomy Future Elements

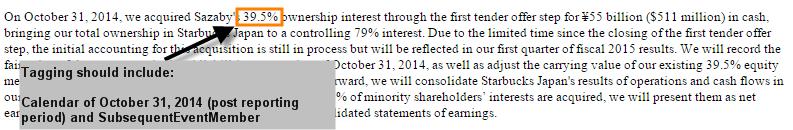

Date Error Example 2: Subsequent Events

Naturally, most concepts in a 10-Q or 10-K will be tagged with a calendar that is prior to or equal to the document’s period end date. This is because it’s the period being reported, but subsequent events, by definition, occur after the end date of the reporting period. Accordingly, they should be tagged with the date on which the subsequent event occurred. It is important, however, to make sure that the event is also specifically indicated as a subsequent event with SubsequentEventMember. Visit XBRL US for additional guidance on subsequent events.

Image Caption: Starbucks Corporation 2014 10-K: Subsequent Events Note

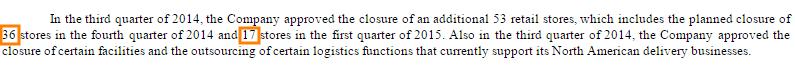

Date Error Example 3: Forecasts

Not every forecast in a financial report will have an existing future element in the US GAAP taxonomy. In some cases, a different approach must be taken. In the example below, the two values in boxes represent the planned number of closures. Because no one can provide assurance of the future, they are forecast for the periods indicated. In this case, it is appropriate to tag the values with the future date indicated in the document. However, it’s also important to further identify them with ScenarioForecastMember since they are not actual facts that have occurred.

Image Caption: Staples, Inc. 2014 10-Q for the period ended November 1, 2014

How Certent Disclosure Management Prevents XBRL Errors

In today’s business landscape, it is important to review your XBRL for proper use of future dates, negative values, axis combinations, and more. Certent Disclosure Management makes it easy to take corrective actions across all of these with its intuitive and unified interface. Incorporating checks for the most common XBRL errors in your document review process will ensure the accuracy of your data and enhance the quality of your filings. Get a demo of Certent Disclosure Management below to see how it can improve your XBRL tagging and reporting for 2026.

The post 4 Most Common XBRL Errors: Messages, Examples, & How to Fix appeared first on insightsoftware.

------------Read More

By: insightsoftware

Title: 4 Most Common XBRL Errors: Messages, Examples, & How to Fix

Sourced From: insightsoftware.com/blog/4-most-common-xbrl-errors/

Published Date: Thu, 30 Oct 2025 15:51:43 +0000

.png)