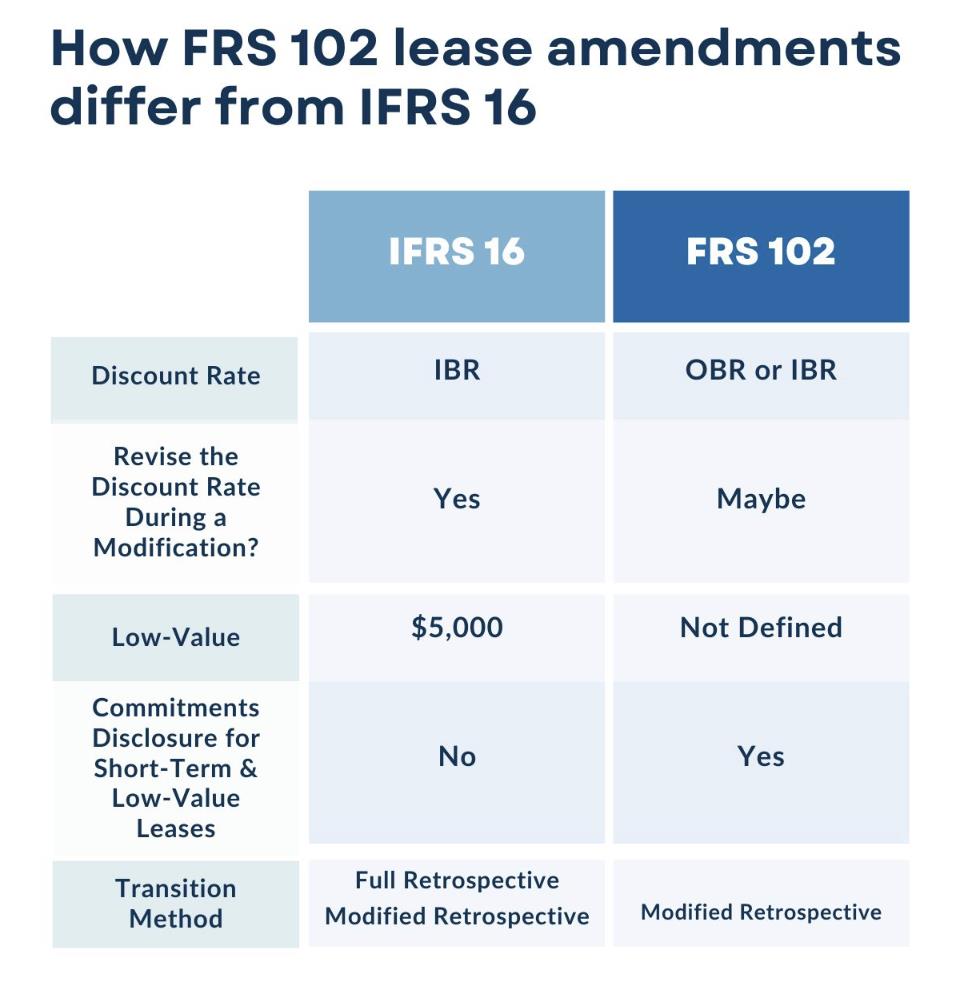

Big changes are coming to accounting in the UK and Republic of Ireland. The Financial Reporting Council (FRC) has issued the most extensive revisions to FRS 102 since the standard’s initial launch in 2013. The revisions will bring UK GAAP closer to IFRS and include fundamental changes to how leases are accounted for and revenue is recognised.

What is FRS 102?

FRS 102 is the Financial Reporting Standard applicable in the UK and Republic of Ireland, which provides a comprehensive framework for the financial reporting of entities that are not required or do not choose to apply International Financial Reporting Standards (IFRS). It sets out the recognition, measurement, presentation, and disclosure requirements for a wide range of transactions and events.

Effective date of changes

The revisions to FRS 102 will be effective for accounting periods beginning on or after 1 January 2026.

Overhauling to align with global standards

The primary driver behind these amendments is intended to:

- Enhance clarity and consistency in financial reporting.

- Improve comparability with IFRS, benefiting businesses with international operations or those seeking foreign investment.

- Ensure continued relevance of financial reporting in the face of evolving business practices and regulatory expectations.

What this means for your organisation

Impact and considerations

These changes will have a wide-ranging impact on organisations reporting under UK GAAP, including:

- Financial Metrics: Impacts to key performance indicators like EBITDA, profit, and net debt may necessitate reviewing debt covenants and performance-related remuneration schemes.

- Systems and Processes: Accounting systems and processes will need updates to accommodate the new requirements for lease and revenue accounting.

- Distributable Reserves: The revised income statement profile, particularly with the recognition of depreciation and interest from leases, could impact the ability to pay dividends.

Next steps: Getting ready for 2026

Changes of this scale require preparation. Here are some key steps to take:

- Impact Assessment: Conduct a thorough review of existing accounting policies, lease agreements, and customer contracts to identify the potential impact of the amendments.

- System Review: Assess whether current accounting software and systems can handle the new requirements. Upgrades or new solutions including lease accounting software may be necessary. Start reviewing new solutions early to ensure sufficient time for selection and implementation.

- Data Gathering: Start collecting the necessary data for lease accounting, including lease terms, payment schedules, and discount rates. Review customer contracts to understand performance obligations and transaction prices.

- Training: Ensure accounting and finance teams are well-trained on the new accounting standards and their implications.

- Early Engagement: Engage with auditors and business advisors early to discuss the potential impact and ensure a smooth transition.

- The FRS 102 Periodic Review 2024 introduces the most far-reaching changes to the United Kingdom and Republic of Ireland GAAP since its initial implementation. In particular, the alignment of lease accounting with IFRS 16 and revenue recognition with IFRS 15 represents a significant shift in accounting practices. By understanding the reasons behind these changes, being aware of the key amendments to lease accounting and revenue recognition, and by taking proactive steps now, businesses can ensure a smoother transition.

Don’t wait until 2026 – the time to prepare is now.

Meet the FinQuery team on stand A9 at Accountex Summit Manchester, taking place at Manchester Central on 23 September 2025.

For further information, please visit www.accountexmanchester.com.

Book your free ticket here.

The post FRS 102 Changes You Need to Know for UK GAAP & IFRS Alignment appeared first on Accounting Insight News.

------------Read More

By: Rachel Reed, FinQuery

Title: FRS 102 Changes You Need to Know for UK GAAP & IFRS Alignment

Sourced From: www.accountex.co.uk/insight/2025/08/19/frs-102-changes-you-need-to-know-for-uk-gaap-ifrs-alignment/

Published Date: Tue, 19 Aug 2025 15:47:07 +0000

Did you miss our previous article...

https://trendinginbusiness.business/finance/five-ways-you-save-five-days-on-your-close-cycle

.png)