Jaguar and Land Rover may be household names synonymous with four-wheeled drives and luxury sports models, but behind the scenes its UK operation is in a state of flux, revolutionising its business operations and finance processes.

Having undergone a major financial transformation between 2018 and 2020 which turned a traditional finance function into a future-proofed contemporary operation with specialist hubs and centres of excellence, the UK business realised it needed to pivot again, but on a much bigger scale.

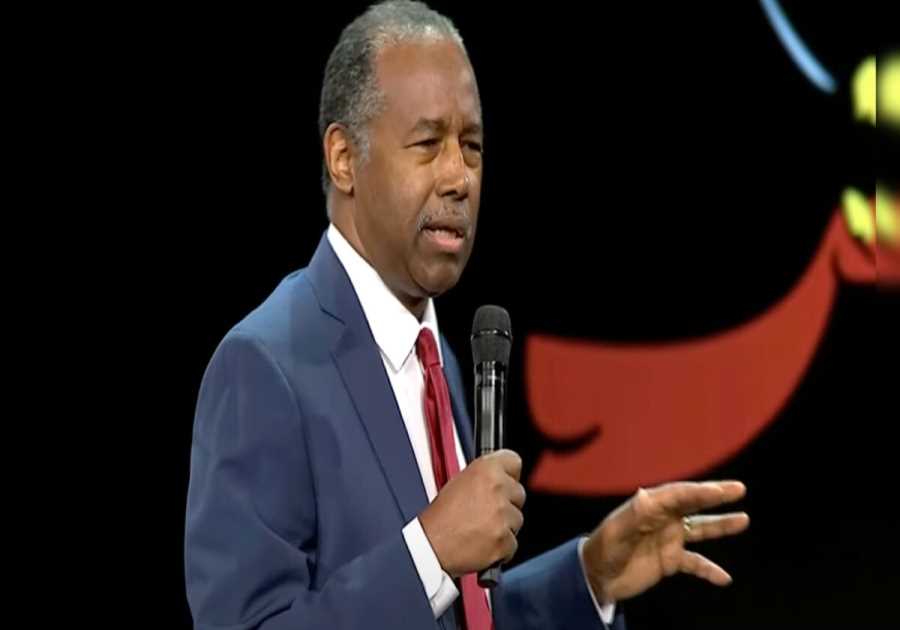

“We’re at the leading edge of a competitive automotive sector,” says Michael Mills, Finance and Transformation Director, Jaguar Land Rover UK.

“It’s a traditional sector but it’s becoming very fast moving and therefore we need to move quickly, otherwise we’ll be dinosaurs in the dust.”

Changing responsibilities and demands

A fast-changing volatile world during and after the pandemic along with shifting customer demand brought the need into sharp focus.

Growing consumer awareness around environmental, social and ethical responsibilities also had an impact.

Michael says customers are adopting electric vehicles ‘quicker’ than anticipated, for example.

A significant part of Jaguar Land Rover’s transformation was also repositioning the brands as ‘the creators of the world’s most desirable luxury vehicles’, products and services that ‘hit the mark’ environmentally and sustainably.

But it’s also about ensuring certain products like electric vehicles are available to meet increased demand. And of course, this response has to align to the wider business strategy.

“As part of our transformation, the UK operation is moving from a Business to Business (B2B) commercial model to a Business to Consumer (B2C) one, which will mean more direct contact and interactions with customers,” Michael explains.

“My focus is in ensuring we have the processes, systems and infrastructure required for this level of change in place to deliver on these new capabilities and guarantee a superb customer experience.”

Roles and responsibilities will inevitably change as a result of this huge shift: teams will become much more customer-focused and staff will need to deal with more calls and emails as well as online interactions through social media channels, all this whilst adjusting to large volumes of transactions.

Updating Jaguar Land Rover UK’s processes

“There will be a lot more data flowing through the system because we’ll have moved from managing a few partnerships to suddenly managing hundreds of thousands of customer relationships directly,” says Michael.

“Customer data will become a big part of this transformation.”

To aid with this, two software programs have been implemented: a data fellowship programme which upskills and trains current employees around data and data literacy and the other is a data intelligence tool which analyses vast swathes of raw data, providing key insights and trends to drive strategy.

The business is also updating several of its existing systems and upgrading online digital capabilities to optimise website and app content, better understand online customer behaviour and help get its message to wider customer demographics using targeted, segmented data profiling and analytics. New payment platforms are needed, too.

“You need different systems depending on payment methods. As you move from a one-time purchase to a subscription model, the systems which underpin these options are very different.”

“Also, the volume of transactions will significantly escalate, so the infrastructure needs to be there: how do I invoice, re-invoice or refund customers at scale, to give the customer a seamless experience where they’re not waiting three weeks for their money back?”

.png)