The new Civil Code now contains a general prohibition on unfair terms in contracts. Before that, the B2B and B2C legislation had already introduced a similar prohibition, but financial services had been (partially) exempted. Such exemption for financial services, however, does not appear in the new Civil Code. This leaves the question as to what extent contracts on financial services (international corporate lending in particular) are now caught by the general prohibition on unfair terms in the new Civil Code.

This contribution looks into the arguments and attempts to create some clarity in a blurry picture.

Unfair terms: Article 5.52 of the new Civil Code, the B2B and the B2C regime

Article 5.52 of the new Civil Code introduces a general prohibition on the use of unfair terms which qualifies as mandatory law:

“Any term which cannot be negotiated and which creates a manifest imbalance between the rights and obligations of the parties is unfair and will be deemed unwritten.

The assessment of the manifest imbalance takes into account all circumstances around the entry into the agreement.

The first paragraph does not apply to the determination of the main performances of the agreement nor to the equivalence of the main performances.”

As such, the introduction of a prohibition on unfair terms is not new: apart from specific lex specialis (such as the SME lending law), we already have:

- the B2C regime in Article VI.82 et seq. of the Code of Economic Law with an exemption for specific categories of financial services introduced by the B2C Finance Royal Decree and the FSMA communication on the application of unfair terms in offers of investment instruments[i]; and

- the B2B regime in Article VI.91/1 et seq. of the Code of Economic Law which contains a full exemption for “financial services”[ii]

The application of these specific regimes prevails over the general regime provided by Article 5.52 of the new Civil Code. This follows from the general principle of lex specialis derogat generalibus and is confirmed in the explanatory memorandum of Book 5 of the new Civil Code:

- “The proposed text [of the new Civil Code] is only applicable without prejudice to the special rules provided under the Code of Economic Law and the specific laws. It does not change the protection of consumers under articles VI.82 et seq. of the Code of Economic Law […]. The text does not change the protection of enterprises under Article VI.91 et seq. of the Civil Code. […] In the context of C2C relations (and more generally any agreements falling outside Article VI.82 et seq. and Article VI.91 et seq.) the text [of the new Civil Code] will apply, […]”.[iii]

- Prof. dr. Jafferali: “It is extremely clear that some provisions to protect against unfair terms in B2C and B2B relations, as they follow from the law of 4 April 2019, are unchanged and will continue to be applied entirely. In reality, Article 5.52 [of the new Civil Code] constitutes a security net.”[iv]

In respect of B2B scenarios, one could consider whether Article 5.52 of the new Civil Code should not apply as a residual law to financial services since these are specifically exempt and therefore not regulated as such by the B2B regime.

There are arguments to the contrary, i.e. that financial services should have a specific regime applicable to them, such as the exemption under the B2B regime, so that the new Civil Code provision should not apply to financial services in B2B scenarios:

- at the time of the introduction of the B2B regime, the legislator considered that a national protection regime would adversely affect the international nature of financial services. Boedts[v] refers to credit agreements using the Loan Market Association (LMA) documentation which would need Belgian-specific clauses which could reduce the transferability and liquidity of these loans. This reasoning in respect of the international nature of financial services still holds true;

- an application of the general unfair terms rule included in Article 5.52 of the new Civil Code to financial services may necessitate additional legislative measures to be taken. This was deemed necessary under the B2C regime. Because there is no general exemption for financial services included in the B2C regime, a Royal Decree subsequently included certain specific exemptions for certain financial services. If the intention of the legislator was that the new Civil Code should be applicable to financial services generally, one would have expected the legislator to include similar exemptions in line with the approach taken for the B2C regime. However, this is not the case;

- the legislator did not repeal any of the B2B provisions or the exemption for financial services in the text of Book 5 of the new Civil Code and there is no reference to the financial services exemption being reviewed in the explanatory memorandum[vi]; and

- one could argue that to the extent that the B2B regime as lex specialis prevails over the new Civil Code, it should prevail in its entirety, i.e., including the financial services exemption. Otherwise, based on the same reasoning, one could argue that the specific financial services which have been exempted by the B2C Finance Royal Decree would now also have to be governed by Article 5.52 of the new Civil Code.[vii]

However, based on the text of Article 5.52 of the new Civil Code, these arguments can be countered, and legal scholars and practice have generally come to the conclusion that, since financial services are exempted from the B2B unfair terms regime, the lex generalis, i.e., the new Civil Code, should apply to financial services:

- Article 5.52 of the new Civil Code is a residual provision and constitutes a safety net;

- an exemption included in a lex specialis such as the B2B regime has no erga omnes effect and must be interpreted restrictively;

- Book 5 is the most recent law: it can be assumed that the legislator would have reiterated the exemption in Book 5 should it have intended to uphold the exemption;

- the exemption for financial services under the B2B regime is not carved in stone. The B2B regime prohibiting unfair terms provides that it can be extended to certain financial services by way of a Royal Decree. The gap was instead filled by Article 5.52 of the new Civil Code.

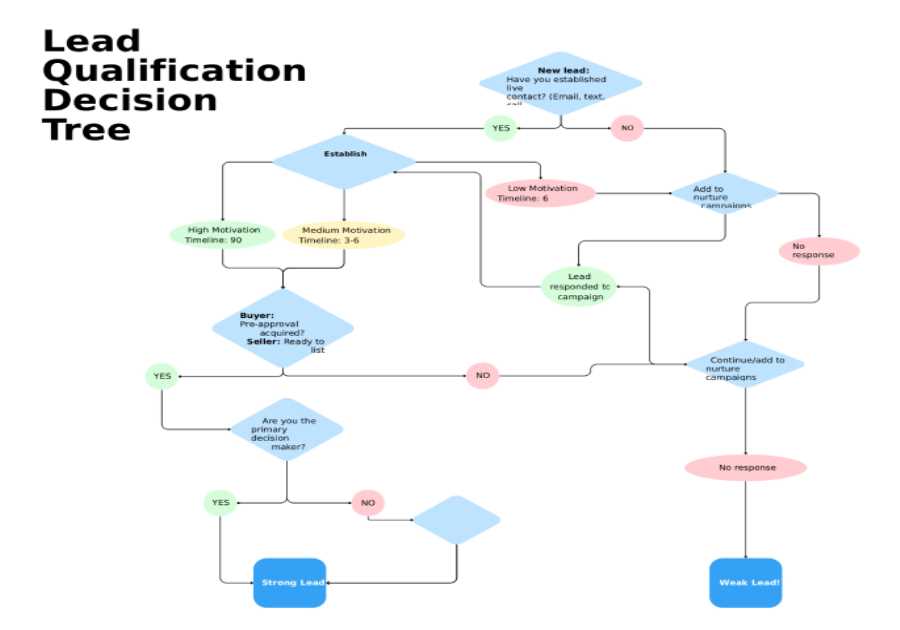

Based on the latter view, this is what the simplified unfair terms landscape looks like (reasoning down from lex specialis to lex generalis):

The application of Article 5.52 of the new Civil Code on financial services (in a B2B context)

Assuming that Article 5.52 of the new Civil Code should indeed apply to financial services in a B2B context, we should assess when exactly it comes into play. As mentioned, under Article 5.52, a term is “unfair” to the extent that (i) it is a term which cannot be negotiated (a non-negotiable term) and (ii) it creates a manifest imbalance between the rights and obligations of the parties. Furthermore, the provision does not apply to the main performances under the agreement or their equivalence. As a result, not every single clause which may look somewhat imbalanced at first sight will effectively be deemed “unfair” under Article 5.52 of the new Civil Code: a combination of these three elements is required.

Clearly, the legislator has chosen to leave substantial room for interpretation by the judge. Article 5.52 of the new Civil Code and the explanatory memorandum do not contain clear-cut definitions of what is to be considered a non-negotiable term, a manifest imbalance or the main performances (and their equivalence). While this room for interpretation allows flexibility in jurisprudence, it also creates uncertainty, which, especially in a sector in need of legal certainty like the financial sector, might be problematic.

The notion of non-negotiable terms is larger than the original concept of “affiliation contract” (toetredingscontract/contrat d’adhésion) which was included in the first draft of Article 5.52 of the new Civil Code. In addition to the below insights from the explanatory memorandum, the preparatory works also contain some references to, among others, the Draft Common Frame of Reference (DCFR) and the French Civil Code. These are worth exploring to better understand the sources of inspiration for the notion of “non-negotiable terms” and are set out in the endnotes to this contribution.[viii]

The original explanatory memorandum – at that time still referring to the notion of affiliation contract – provides that it must be assessed in concreto whether the other party had the opportunity to influence the content of the contract, considering the economic balance of power between the parties, irrespective of whether the opportunity to influence was effectively used. On the other hand, the fact that there were negotiations on certain aspects of the contract, will not necessarily mean that other terms would not be qualified as non-negotiable.

This is also relevant for international finance practice where there are contracts containing non-negotiable terms (or which even qualify as affiliation contracts). One can think of general terms and conditions for banking or investment services, clearing services agreements, securities payment and delivery agreements, accession contracts in respect of exchanges, payment agreements, etc. Most of these agreements contain an element of financial infrastructure or systemic stability ensuring the financial system as a whole can continue to function, which can justify the use of certain non-negotiable terms.

It could also be argued that LMA credit agreements contain terms which are not systematically negotiated or negotiable, in particular the so-called boilerplate clauses. Arguably however, LMA agreements are the result of consultations between market participants and are intended to streamline market practices. The fact that certain (boilerplate) clauses could be, but are typically not (heavily) negotiated time afer time is a matter of efficiency rather than unfairness. The LMA agreements could instead be used as a reference of what is acceptable and fair in the market. For the assessment of the manifest imbalance, the legislator has indicated that customary practices (toepasselijke gebruiken/usages applicables) should be taken into account. It would therefore be logical to do the same when assessing the negotiability of a clause. In addition, the determining factor is that parties should have the opportunity to negotiate these clauses, which is typically the case. The fact that parties do not (often) negotiate certain clauses in practice is in principle irrelevant although this may increase the burden of proof.

In order to mitigate the risk that a court would qualify terms as non-negotiable, parties can take the following measures:

- keep evidence of the negotiation process (e-mails, meeting notes, etc.);

- ensure that all parties had the opportunity to negotiate all clauses, with the necessary legal support;

- avoid stating in any communication that certain clauses are non-negotiable, and instead explain why provisions are key and market-practice;

- include a header in contracts stating that it is a draft for negotiation purposes; and

- include a preamble in contracts explaining the negotiation process.

In order for Article 5.52 of the new Civil Code to apply, there must also be a manifest imbalance between the rights and obligations of the parties. This concept is well known under Belgian law. It implies that a judge should take a restrictive approach and cannot set aside the agreement between the parties too lightly, based on the principle of contractual freedom.

The explanatory memorandum helpfully provides that the assessment of the manifest imbalance has to consider all circumstances around the entry into the agreement. By way of example, reference is made to the nature of products or services, other provisions of the agreement, the general economy of the agreement, a connected agreement or customary practices. That last point is, as mentioned above, highly relevant for international finance practice. LMA credit agreements should fall within that category as they are generally considered to be based on market practice and internationally accepted standards.

An element which is not covered by the explanatory memorandum is the discussion around deviations from supplementary law. Under the B2B regime it was provided that in assessing the unfair nature of terms, the judge could also take into account supplementary law by comparing the contract with the normal (supplementary) legal regime which would have applied had the provision not been included.[ix] This reasoning was disputed in legal doctrine.[x] Legal scholars argued that this was an incorrect application of a reasoning that the European Court of Justice made in a specific B2C context which, in principle, should not apply outside that context.[xi] It can indeed not have been the intention of the legislator that in the event of deviation by parties from provisions of supplementary law, such deviation is considered to be an unfair term. Otherwise, it would indirectly turn supplementary law into mandatory law. The fact that this reasoning is not retained as such with the same wording in the explanatory memorandum of Article 5.52 of the new Civil Code is positive.[xii] In a strict reading this could otherwise potentially cause issues for B2B financial services agreements such as LMA credit agreements and security agreements, where it is customary to deviate from Belgian supplementary law provisions in order to, among others, align with international practice.

A further element to consider is that the prohibition of unfair terms under Article 5.52 of the New Civil Code does not apply to the main performance(s) of the agreement, nor to the equivalence of these main performances.

In a bank financing context, this would mean that Article 5.52 of the new Civil Code would, as a minimum, not apply to the clauses concerning the provision of the loan and the payments of interest and principal[xiii] as well as the equivalence between both. Representations and warranties, undertakings, events of default etc. could also be considered to be an integral part of the main performances, in particular to the extent that they could trigger an acceleration, mandatory prepayment or a drawstop.

On the other hand, the surrounding framework, procedural and boilerplate clauses, are less likely to qualify as main performances for this purpose. In a bank financing context, this could include clauses in respect of changes to the parties, administration clauses (including calculations and certificates, remedies and waivers, amendments, etc.) and other similar clauses.

The final question for this contribution concerns private international law: can the choice of a different governing law in the agreement set aside the application of Article 5.52 of the new Civil Code?

Pursuant to the B2C regime included in the Code of Economic Law, it is explicitly prohibited to choose a law applicable to the contract.[xiv]

For the B2B regime included in the Code of Economic Law, the parliamentary works provide that it is a “loi de police” which falls under the rules of special mandatory law (bepaling van bijzonder dwingend recht/lois de police) under Article 9 of the Rome I Regulation.[xv] This qualification gave rise to a lot of comments in doctrine since such qualification should only apply to “provisions the respect for which is regarded as crucial by a country for safeguarding its public interests, such as its political, social or economic organisation, to such an extent that they are applicable to any situation falling within their scope, irrespective of the law otherwise applicable to the contract under this Regulation”.[xvi] If this qualification were to be upheld despite this controversy, a Belgian judge will be obliged to apply the provisions of special mandatory law notwithstanding the choice for another law.[xvii] In a similar vein, a foreign judge may apply provisions of special mandatory law of the country where the obligations have to be or have been performed in so far as those overriding mandatory provisions render the performance of the contract unlawful.[xviii]

Under Article 5.52 of the new Civil Code, there are no specific provisions limiting the choice of law. The parliamentary works also do not seem to qualify article 5.52 of the new Civil Code as “special mandatory law” within the meaning of the Rome I Regulation (it does, however, qualify as national mandatory law). On that basis, the legislator seems to have abandoned the approach it has taken under the B2C and B2B regime. Parties should, however, be aware that there may be other limitations:

- the chosen law may contain a similar unfair terms rule. This is for example the case in Dutch, French and German law[xix];

- private international law rules may provide that, in certain circumstances, parties cannot deviate from certain local law provisions. For example, if all other elements relevant to the agreement at the time of the choice are located in another country (e.g. Belgium) than that of the chosen law, pursuant to the Rome I Regulation, the choice of that law will not prejudice the application of provisions of the law of that other country which cannot be derogated from by agreement[xx]; and

- it may not be desirable to choose another applicable law for other reasons (practical or otherwise).

Accordingly, although parties could in principle choose a different applicable law this may not always give the desired outcome.

In conclusion

The introduction of Article 5.52 of the new Civil Code and its application to financial services in a B2B context has caused some worry in the Belgian B2B financing sector, which has historically been able to benefit from an exception for financial services under the B2B unfair terms regime.

As previously discussed however, in order for a clause to be deemed “unfair” under Article 5.52 of the new Civil Code, the term should (i) be non-negotiable, (ii) not relate to the main performance, and (iii) contain a manifest imbalance (taking into account amongst others applicable circumstances and customary practices). The occasions where the three criteria will simultaneously be fulfilled in a B2B banking context will probably be rather limited.

It is, however, unhelpful that the new Civil Code refers to “non-negotiable terms” as opposed to “affiliation contracts” which is the term used in the French legislation and the original draft of Article 5.52 and the corresponding explanatory memorandum. This term seems to leave more room for interpretation to the courts which creates uncertainty. There are however ways to mitigate the risk set out above.

To the extent that there are circumstances in which parties would have a legitimate interest to include terms which could technically speaking be considered as “unfair” terms under Article 5.52 of the new Civil Code – this could for instance be the case where the relevant contractual term is meant to reduce systemic risks, supports the functioning of financial market infrastructure, ensures participation in the international finance markets etc. – legislative intervention with the provision of specific exemptions may be desirable. This has also been done for purposes of the B2C regime and could, in respect of the new Civil Code provision, potentially be linked to the review of the B2B regime which is in principle due for December 2022.

Els Janssens

Senior Knowledge Lawyer (Finance)

Head of Knowledge & Learning Belgium

Linklaters Brussels

The views and opinions expressed in this contribution are strictly my personal views and focused on LMA-based international corporate lending. Legal texts have been freely translated to English. I wish to thank Bruno Garcia Da Silva for his research on the concept of non-negotiable terms.

[i] See Royal Decree of 23 March 2014 taking special measures and derogations from certain provisions of Book VI of the Code of Economic Law for certain categories of financial services, Belgian State Gazette 3 April 2014 and FSMA Communication 2017/04 on the position of the FSMA on the application of the Belgian rules on unfair contract terms to some clauses as part of the offer of investment instruments, https://www.fsma.be/en/news/communication-position-fsma-application-belgian-rules-unfair-contract-terms-some-clauses-part.

[ii] Law of 4 April 2019 amending the Code of Economic Law with regard to abuse of economic dependence, unfair terms and unfair market practices, BS 24 May 2019. Article VI.91/1 Code of Economic Law (B2B): “This title does not apply to financial services. The King may, by Royal Decree and subject to the advice of the National Bank of Belgium and the FSMA, apply some of the provisions of this title to the financial services that he determines”. The explanatory memorandum clarifies that it concerns any service relating to banking activities, credit provision, insurance, individual pensions, investments and payments and specifically mentions that the exemption applies to all MiFID-type financial instruments as set out in Article 2 of the Law of 2 August 2002. For more information see our client alert of 2020:

B2B legislation in the spotlight: the financial industry will not escape its reach | Linklaters

[iii] Explanatory Memorandum, Doc. 55, 1806/001, p. 57.

[iv] Report Doc. 55, 1805/004, p. 29.

[v] T. BOEDTS and D. DE BRUYNE, “De impact van de B2B-Wet op financiële diensten en financiële instellingen”, D.B.F.-B.F.R. 2020/1, pp. 42-57.

[vi] There is only a reference to the planned review of the B2B regime: “It will be up to the legislator to decide, in view of the planned review of the law of 4 April 2019 and the assessment thereof by doctrine whether [the B2B regime] is to be maintained or whether the interests of companies are already sufficiently protected by the general provisions introduced in Book 5 [of the new Civil Code].”

[vii] The situation is however somewhat different for this B2C Finance Royal Decree of 23 March 2014: rather than carving out some financial services from the B2C regime it contains specific exemptions for specific financial services from specific rules.

[viii] In amendment n° 21 (Doc. 55, 1806/004) which changes “affiliation contracts” to “non-negotiable terms”, one can read: “The main problem regarding abusive clauses is that contract terms are imposed on a party, which are to be accepted or not, and over which it cannot exercise any control. In other words, it is about contract terms for which it is not possible for the other party to negotiate.” So, while the amendment extends the scope of application from affiliation contracts to non-negotiable terms, at the same time it also reflects a relatively strict requirement of not being able to exercise any influence over the content, which reduces the application. One can, however, wonder whether this quote is meant to be interpreted so literally.

The explanatory memorandum also refers to the Draft Common Frame of References (DCFR), in which one can find a definition of “terms that are not individually negotiated” (Article 9:403): “(1) A term supplied by one party is not individually negotiated if the other party has not been able to influence its content, in particular because it has been drafted in advance, whether or not as part of standard terms.

(2) If one party supplies a selection of terms to the other party, a term will not be regarded as individually negotiated merely because the other party chooses that term from that selection.

(3) The party supplying a standard term bears the burden of proving that it has been individually negotiated.

(4) In a contract between a business and a consumer, the business bears the burden of proving that a term supplied by the business, whether or not as part of standard terms, has been individually negotiated.

(5) In contracts between a business and a consumer, terms drafted by a third person are considered to have been supplied by the business, unless the consumer introduced them to the contract.”

Interestingly, the fact that an agreement has been drafted by one party in advance is an element of importance in the DCFR to assess whether it is non-negotiable. One may hope that courts will not take too much inspiration from this since (in a B2B context) it is very customary for one party to draft an agreement and the other party to comment on it. Besides, the legislator has seemingly been cherry-picking from the DCFR, seeking inspiration from parts of it but ignoring others.

Finally, the explanatory memorandum also refers to Article 1711 of the French Code Civil which applies to affiliation contracts, more particularly to terms which cannot be negotiated, determined by the parties in advance. « Dans un contrat d’adhésion, toute clause non négociable, déterminée à l’avance par l’une des parties, qui crée un déséquilibre significatif entre les droits et obligations des parties au contrat est réputée non écrite. » The French legislator focuses on clauses which are excluded from the free negotiation of contracts. The author of the agreement must have acted in such way that the clauses cannot be changed, refusing any expression of free will from the adhering party except for the acceptance of the entirety of the clauses. As such, given that this legislation is built around the concept of an affiliation contract, it is unclear to what extent this is relevant for the new drafting of Article 5.52 of the new Civil Code which no longer refers to affiliation contracts notwithstanding the fact that there are similarities between the two regimes.

[ix] Parl. St. Kamer, Doc. 54, 1451/003, p. 34.

[x] See among others: I. CLAEYS en T. TANGHE, “De B2B wet van 4 april 2019: bescherming van ondernemingen tegen onrechtmatige bedingen, misbruik van economische afhankelijkheid en oneerlijke marktpraktijken”, R.W. 2019-2020, nr. 9, p. 332. See more nuanced E. TERRYN, p. 116.

[xi] Court of Justice 14 March 2013, C-415/11, Aziz, para 68.

[xii] There is however, a mention in the explanatory memorandum (Doc 55, 1806/001, p. 58) “[…] To determine such imbalance, one has to compare the rights and obligations of the parties when the contract contains the contested term and when the contract would not contain the contested term.” This drafting is however not as strong as it is in the parliamentary works in respect of the B2B regime and does not refer to deviations of supplementary law as such.

[xiii] This would include all pricing mechanisms. Contra: E. TERRYN, “Onrechtmatige bedingen tussen ondernemingen”, ” in Nieuw economisch recht in B2B-relaties, Antwerp, Intersentia, 2020, pp. 95-147 for price indexation clauses, payment terms etc. in a more generic context.

[xiv] See Article VI.84, §2 Code of Economic Law which provides that the choice of law where the law of a third country (non-EU member state) is chosen is deemed unwritten if it appears that the protection of the chosen law is more limited than had EU law been applicable without the choice of law.

[xv] Parl.St. Kamer, Doc.54, 1451/003, p. 34.

[xvi] Article 9.1 Regulation No. 593/2008, 17 June 2008 on the law applicable to contractual obligations, Pb.L. 4 July 2008, OJ L 177/6 (Rome I Regulation).

[xvii] Article 9.2 Rome I Regulation.

[xviii] Article 9.3 Rome I Regulation.

[xix] For more detail see S. GEIREGAT and R. STEENNOT, “Impact van de B2B-wet op de wilsautonomie en de rechtszekerheid: een rechtsvergelijkende analyse”, Tijdschrift voor privaatrecht 2019, pp. 973-1053.

[xx] Art. 3.3 Rome I Regulation.

------------Read More

By: Corporate Finance Lab

Title: The unfair terms prohibition in Article 5.52 of the new Civil Code and financial services in a B2B context: balancing fairness with legal certainty

Sourced From: corporatefinancelab.org/2022/12/05/the-unfair-terms-prohibition-in-article-5-52-of-the-new-civil-code-and-financial-services-in-a-b2b-context-balancing-fairness-with-legal-certainty/

Published Date: Mon, 05 Dec 2022 13:50:04 +0000

Did you miss our previous article...

https://trendinginbusiness.business/finance/3-minutes-with-rob-brown

.png)