This posting is for everyone who doesn’t have money but wants to accumulate free shares of stock.

Owning companies by holding stocks has traditionally been the best investing vehicle over the long term. It usually provides better returns than bonds or cash once you factor in historical ups and downs.

So, I’m constantly looking to accumulate free shares of stock, and you probably should, too. One way I’ve been doing this is by signing up for brokerage accounts in return for free shares of stock. This is a thing these days.

The brokerage industry is exceptionally competitive. A lot of newer companies are offering incentives for people to sign up. They’re basically hoping that once they get you in the door, you’ll move your money into their platform. In a lot of cases, the incentive is free shares of stock.

I’ve checked out most of the companies offering this – and signed up for all of them. These are the ones that:

- Make sense from a cost/benefit, time invested perspective.

- Are based in the United States and regulated by U.S. watchdogs

- Legal/legit (SEC-registered, use decent security tech)

- Actually work.

This list excludes most of the sign-up offers that ask you to put money down – that’s all pretty much nonsense. If you have to pay to get something, it’s not “free”.

The best way is to try all the companies on this list. It will take about an hour and you’ll likely get about a hundred bucks. With compound interest and some luck, it will be worth triple in five years.

Here is the list of four companies to look at to accumulate free shares of stock.

SoFi

If you’re accumulating free shares of stock, SoFi is a good starting place.

SoFi is a San Francisco-based finance company that offers a range of lending and wealth management services. It came out of nowhere about 5 years ago — first in the student loan refinancing space and later on transformed into a generalized financial services company. Its mobile interface is slick and agile. It is also smartly lead and has recently done an IPO.

Signing up is worth about 10 bucks in points, it’s usually either in points or cash. It’s your choice to put this into crypto or stock. It will also let you check your rate on a personal loan or mortgage for $10 and $20 once a year. The play here is to sign up, get the rewards, and check your rates. You should be able to grab twenty extra bucks or so and some stock. You don’t actually have to buy anything.

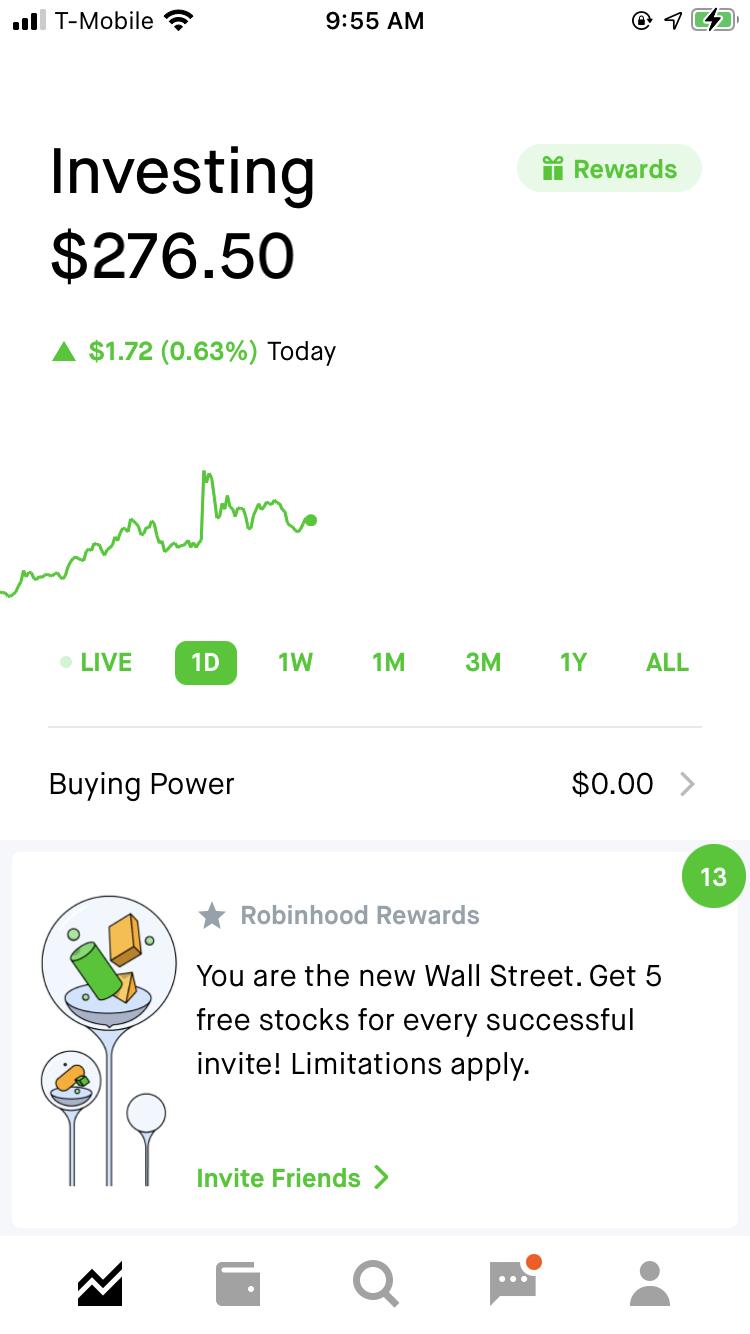

Robinhood

“Robinhood is a stock brokerage that allows customers to buy and sell stocks, options, ETFs, and cryptocurrencies with zero commission,” said Crunchbase.

Robinhood started in 2013 and had good success with penetrating the brokerage market. It also has an immense response among millennials. This is mostly because it has removed all the friction in trading. It handles fractional shares and doesn’t charge fees. Also, more importantly, its app design is superior.

The interface is geared so that interaction takes 30 seconds or less. You log in, trade, and close out, all in less than 30 seconds. Execution times are lighting fast, and Robinhood developers work quickly. They were able to implement dogecoin trading weeks before most of the competition. As a result, Robinhood has achieved a market share of $4.5 Billion.

Robinhood Isn’t Perfect, Pays Out of Favor Stocks

Robinhood isn’t perfect. Back in January of this year (2021), a bunch of people on Reddit got together and decided to run up the price of GameStop Inc, a failing brick-and-mortar game retailer. As part of the scandal, Robinhood decided to stop issuing buy/sell orders on GameStop, citing insufficient collateral. The material truth of the reasons behind its failure to execute trading is yet to be determined in court. However, the company is largely suspected of having an overly close business relationship with one of the hedge funds on the wrong end of the trading run-up. In effect, it is suspected of halting trading to protect its partner’s financial interests at the expense of its customers.

Most of what it is offering as an incentive are second or third-tier tech or pharmaceutical stocks. Usually, you’ll get something worth between $3 and $6, but you can easily sell it and buy the index or something you think will perform better in the long run.

Sign-up here.

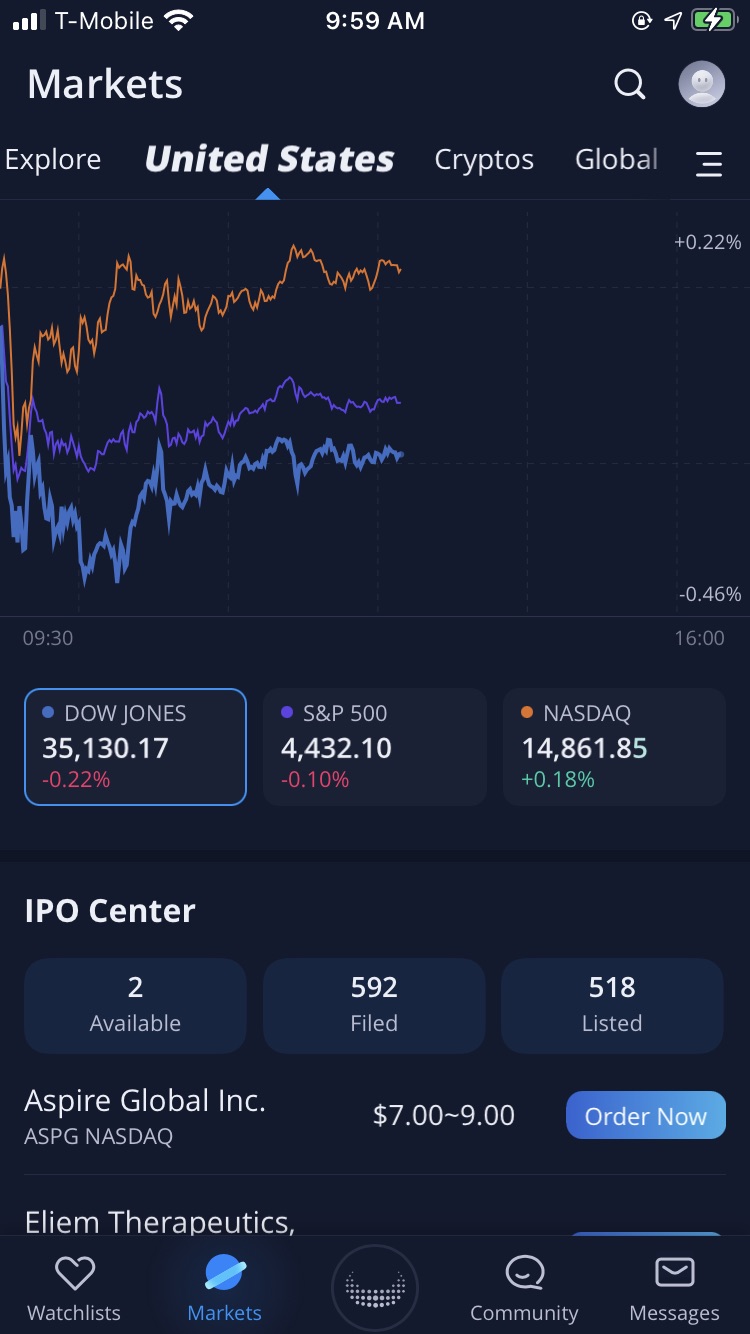

Webull

Number four on the “accumulate free shares” shopping list is Webull Securities. Known as Webull Financial LLC, it is the American arm of Chinese-based Fumi Technology. Webull was founded in the United States in 2017 and likely has $30 billion or less in assets under management.

The upside to Webull is it doesn’t charge for trading — it costs $0 to trade stocks.

Webull has a number of serious drawbacks. Its interface isn’t well-designed and requires a great deal of toggling back and forth to look at the total value of your portfolio. This is especially the case with its desktop version. While most reviews don’t agree on this point, I found its trading interface challenging.

Also, the interface is basically built for traders. The default graph is a candle chart. It provides good market volume and price data, but not much that a fundamental individual stock investor would appreciate.

It also doesn’t handle fractional shares, which is a pain if you don’t have a huge amount of capital to invest.

There are some advantages to Webull’s platform. It doesn’t charge you much, trades are basically free, and there aren’t any account fees.

The one real upside is that Webull will give you free stock. What you get is usually moderately priced middle-tier stocks such as General Electric, Antero Midstream Corp, or Ambev S.A. Some of these pay dividends. It will require you to sign up and deposit $100 to get two shares of stock. However, you can sign up and get the first share for free. You don’t have to make a deposit.

The Webull sign-up link is here.

Public

Last in our list of companies to look at to accumulate free shares of stock is Public. Formerly known as Matador, it is a mobile trading application that combines elements of a brokerage and a social network. The company was founded in 2018 by Entrepreneurs Matt Kennedy and Jannick Malling. Since Public isn’t publicly traded, it doesn’t make a whole lot of its information public. According to industry index Crunchbase, Public is running on $308.5 Million in venture capital funding.

Getting free stock with Public is pretty easy. You just download the mobile app. It will ask you to answer standard questions, get your bank account linked up, and move some money into your Public account — I moved $1. You get to select which company you want a chunk of. The good news is, all the companies it offers are good growth or value names such as Tesla Motors. It will give you a ‘slice’, so a fractional share of the company.

Public’s sign-up is here. Their corporate site is at Public.com.

Honorable Mentions:

Coinbase

Coinbase isn’t a stock account. It is a leading cryptocurrency brokerage firm. The crypto space is like the wild west — there is a tremendous amount of energy in this sector of the economy. So, it makes sense to have access to it. Since Coinbase is a leading brokerage, it’s a good place to start if you want access to crypto.

There are several ways you can get free money from Coinbase.

First, you can sign up and get $5.

Second, Coinbase offers rewards, which are basically small grants of various cryptocurrencies. You get these for watching short videos about the specific cryptocurrency. So, it’s not free stock but it’s nearly free cryptocurrency.

Third, a lot of cryptocurrencies are actually making payments on the amount you have invested these days – so you could sell what Coinbase gives you and put your funds into something that will give you a 4% to 6% cash or crypto return.

Their sign-up page is here.

Delphia

Delphia is a Robo-Advisor. What it is essentially trying to do is predict the price of a given company’s shares using social media analysis. The thinking goes like this: earnings are the strongest predictor of change of a given stocks price. However, it’s very difficult to predict earnings. Delphia thinks it has this problem solved by using social media to predict earnings — assuming that people will mention the products they buy on their social media accounts — which seems like a plausible assumption.

It is basically collecting social media data from users who sign up. It should be able to aggregate the data into some sort of predictive model provided it has enough users.

The website is here. Its app is still pretty experimental — and it shows. It’s not clear if it has enough users to make its model work. However, if it can crack the prediction problem, its returns could be very interesting. Also, its customer service is solid, even if its interface is mostly in beta.

You can get free money from Delphia when you sign up. Basically, you’ll get everything signed up and it awards you bonuses based on a lottery ticket system. The more social media account information you share, the more tickets you get. Delphia has the lottery system organized so you’ll only get a couple of bucks a month, but that’s fine. It’s totally passive and it puts your money into well-diversified index funds.

Companies to Avoid

If you want to accumulate free stock, avoid these companies.

There are a number of other Fintech companies out there — M1 Finance and Invstr are all good examples. Most of these require an upfront investment, which means they’re not “free.” Dough and MooMoo are no exception.

Dough

Dough is the stock trading arm of tastytrades. The company used to have a nice “free to sign up” offer. However, it recently changed its terms — requiring a deposit and closing inactive accounts. This seems like a silly move to me — as people who signed up constitute a marketing base for Dough to work with. Its competitions such as Webull and Firstrade have been successful in growing their assets under management. I suspect what’s happening is Dough’s leadership is new and is making poor decisions. In any event, you can’t do a buy and hold strategy with Dough under its current terms, so cash-constrained small investors should steer clear.

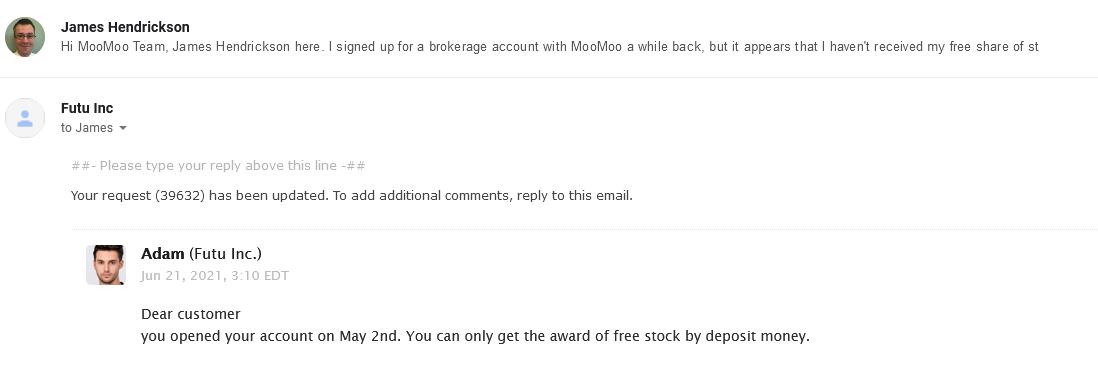

MooMoo

MooMoo is a commission-free stock trading company located in the San Francisco bay area. I can’t say too much about MooMoo, other than that it looks like its offer isn’t really free. For example, its homepage looks like you can sign up and get 1 free stock.

So, I went ahead, signed up, and waited a couple of months. No stock showed up. So I emailed its customer service. The answer back was: you need to make a deposit to get the stock. This basically means it’s not free.

Accumulating Free Stock – Small Ball & Hassles

Yes, getting free shares of stocks is a “small ball” in that the amount you get is usually pretty low, but free sign-ups are a viable way to accumulate free shares of stock if you’re cash-constrained.

With all of these, the idea is just to sell any garbage you get and buy the S and P or a blue-chip stock.

The only problem getting a lot of accounts is the administrative complexity. You’ll get multiple statements and you’ll have to keep track of multiple logins. That said, who doesn’t have hundreds of online accounts these days? And as long as you stay organized, multiple accounts should not be a big deal.

For more great articles, read these:

The Best Time To Buy And Sell Mutual Funds To Make The Most Money

How To Convince Your Spouse To Invest In Stocks

Yes, You Can Buy An Oil Well

The Pros And Cons Of Investing In Mutual Funds

Building Wealth on $600 Per Month

Anton Kreil’s Stock Trading Is Not What You Think

Disclosure of Material Connection: Some of the links in this article are affiliate links. This means if you click on the link and sign up, Dinksfinance will get an affiliate commission. I am disclosing this per the Federal Trade Commission’s 16 CFR, Part 255.

------------Read More

By: James Hendrickson

Title: Yes, You Can Accumulate Free Shares Of Stock

Sourced From: www.dinksfinance.com/2023/05/accumulate-free-shares-of-stock/

Published Date: Mon, 29 May 2023 16:48:14 +0000

.png)