Chelsea Jia Feng/Insider

- Sam Bankman-Fried, cryptocurrency's former golden boy, is on trial in Manhattan federal court.

- His former friends and executives took the stand against him and said they stole money together.

- Here are the biggest bombshells from the trial so far.

Sam Bankman-Fried's criminal trial has been a treasure trove of revelations about the former crypto king.

Dethroned from his cryptocurrency empire, Bankman-Fried has stood trial the last few weeks in a Manhattan federal court.

Prosecutors allege Bankman-Fried siphoned billions of dollars from customers of his crypto exchange, FTX, to his personal crypto hedge fund, Alameda Research. Three of his close friends and executives — Caroline Ellison, Gary Wang, and Nashad Singh — have all pleaded guilty and testified as cooperating witnesses, saying they co-conspired with Bankman-Fried in the plot.

Here are the wildest details from the trial so far.

1. SBF believed there was a 5% chance he'd be president

If the trial has established anything, it's that Bankman-Fried had an inflated view of himself.

In addition to being the leader of a major cryptocurrency exchange, the FTX founder thought he might eventually become the leader of the free world, Caroline Ellison testified.

"He said there was a 5% chance he might be president someday," Ellison, the former CEO of Alameda Research and his ex-girlfriend, testified.

2. He placed a high value on his mane of curls

As he aimed high with his potential, Bankman-Fried did the same with his hair. Since being remanded to a federal detention center in Brooklyn, he has gotten a shorter haircut. The Wall Street Journal reported it was another inmate who cut his hair.

But Bankman-Fried previously said his mane of unruly black curls was "essential to his image," Ellison testified.

"He thought his hair was very valuable," Ellison said, noting that Bankman-Fried believed he'd gotten higher bonuses in past jobs due to his hair.

3. The stress of the scheme left a key executive 'suicidal for days'

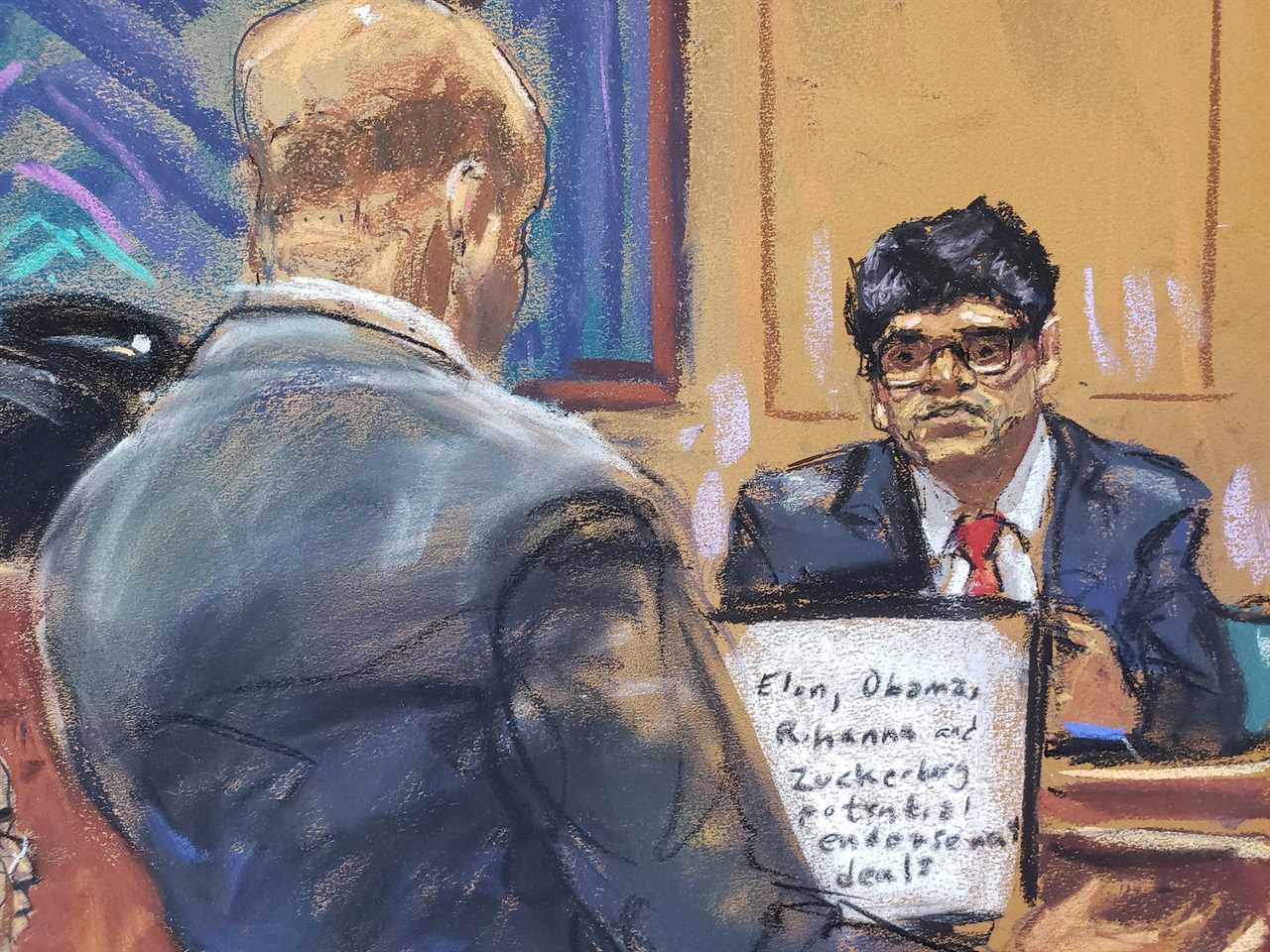

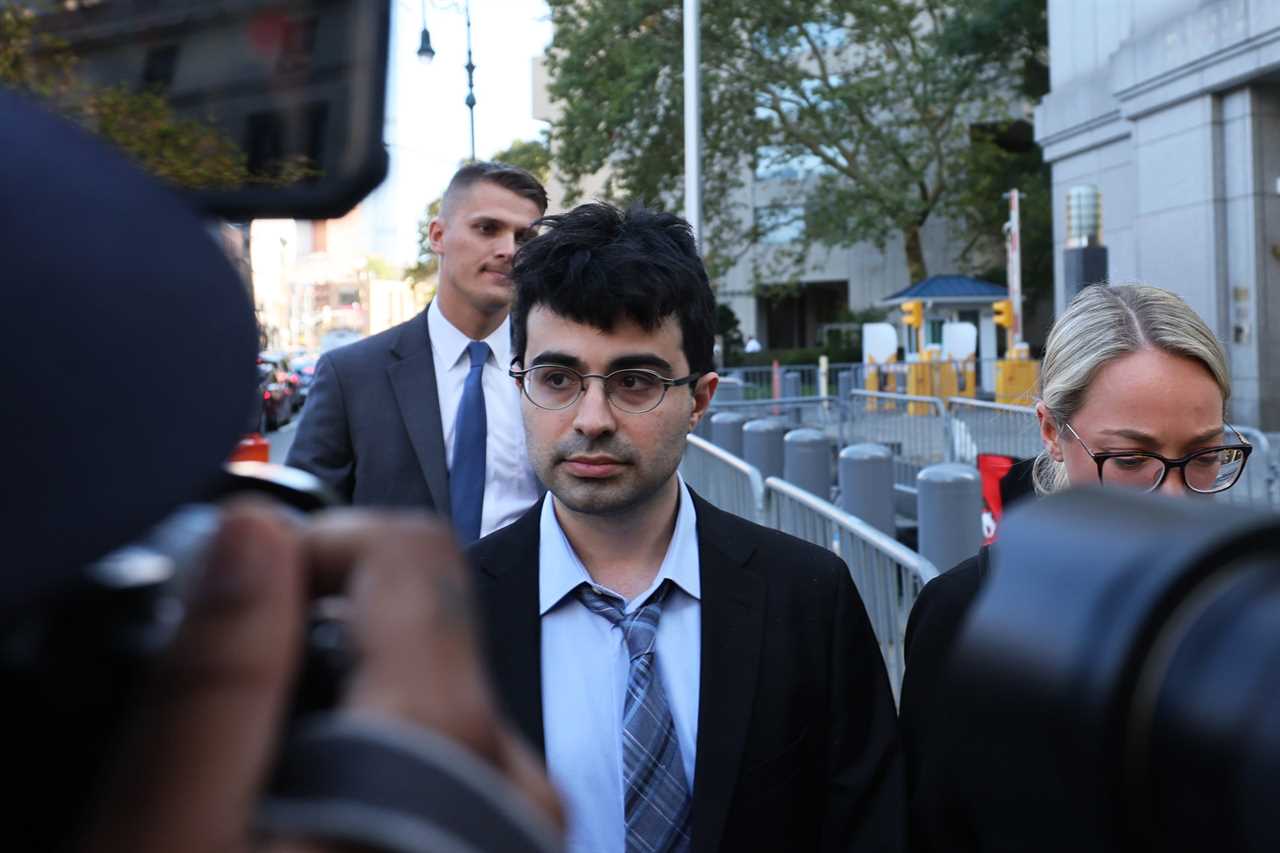

Jane Rosenberg/Reuters

Nishad Singh, the head engineer at FTX, testified against Bankman-Fried and spoke to the intense pressure of the scheme. Singh, who pleaded guilty to financial crimes and cooperated with prosecutors, had a significant stake in the company and was among the last in Bankman-Fried's inner circle to find out Alameda was pilfering FTX customer funds.

As customers began to withdraw their deposits, FTX didn't have enough liquid cash to actually give them their funds. Instead of working together to solve the issue, executives blamed each other, Singh testified.

"I'd been suicidal for some days," Singh said. "Now more than ever, to salvage whatever we could, FTX employees needed to be productive, and resolving the blame game quickly and definitively seemed like it would be a path towards that."

4. Bankman-Fried's co-conspirators knew they were doing something wrong

Ellison, Singh, and Wang all testified that, even before they met with prosecutors and pleaded guilty, they knew taking customer funds was the wrong thing to do — and did it anyway.

"Customers did not agree for us to use their funds," Wang testified.

Only six days after FTX's bankruptcy, Wang flew to the United States from FTX's headquarters in the Bahamas and met with prosecutors.

"I thought I was likely to be charged and I wanted to get a shorter prison sentence," said Wang, FTX's co-founder and chief technology officer.

Ellison said Bankman-Fried justified lying through his utilitarian philosophy.

"He said that he was a utilitarian, and he believed that the ways that people tried to justify rules like don't lie and don't steal within utilitarianism didn't work," Ellison testified. "And he thought that the only moral rule that mattered was doing whatever would maximize utility."

5. Bankman-Fried had an angry streak

Angela Weiss/AFP via Getty Images

Singh testified that Bankman-Fried sometimes snapped in anger when he pushed back on the FTX CEO's spending habits and pressed for ways to pay back customers.

When Singh suggested they buy a cheaper home in the Bahamas than the $35 million penthouse they ultimately purchased, Bankman-Fried effectively told him to shut up, he testified.

"Sam said that he would pay $100 million for the drama to just be done with and go away, which I took as a pretty clear sign that I should shut up and we should move forward with this," Singh said.

On another occasion, Bankman-Fried was visibly upset when Singh expressed anxiety about getting enough money for FTX customers.

"Sam has some physical twitches for when he gets angry," Singh said.

"Puffed out his chest, had his hands back, he was grinding his finger, closing his eyes, grinding his teeth or tongue in his mouth," he added. "When he opened them to respond, he would sort of glare at me with some intensity."

6. SBF faced a confrontation with a colleague on a paddle tennis court

Adam Yedidia, a software developer at FTX, described one tense conversation he had with Bankman-Fried after playing paddle tennis.

Under a hut between the courts, Yedidia asked a "worried" and "nervous" Bankman-Fried if things were "okay" regarding the debt Alameda owed to FTX customers.

"In response, Sam said something like, 'We were bulletproof last year, but we're not bulletproof this year,'" Yedidia testified.

7. FTX didn't realize for months that a bug miscalculated its balances by hundreds of millions of dollars

Michael M. Santiago/Getty Images

Jurors have spent a lot of time in the trial hearing about a bug in FTX that miscalculated Alameda's deposits on the exchange.

Yedidia testified he may have "inadvertently" introduced the bug into FTX's code while working on a tool that helped automate customer deposits in 2021.

In December of that year, FTX discovered that the bug in the code overstated how much Alameda owed to FTX customers. By the time the bug was discovered, the balance was off by $500 million.

The bug wasn't fixed until June 2022. By that time, Alameda's understated liabilities on FTX had reached $8 billion.

8. Bankman-Fried was told it was a bad idea for him to date Ellison

Yedidia and Bankman-Fried were friends at MIT, where they lived together. Before Yedidia joined FTX in 2021, the two engaged in a bit of locker-room talk.

"Sometime in early 2019," Yedidia testified, Bankman-Fried "told me that he and Caroline had had sex and asked if it was a good idea for them to date."

"I said no," Yedidia added, noting that Bankman-Fried "figured that was reasonable and thought that I would say something like that."

9. Bankman-Fried may have paid a $100 million bribe to Chinese officials and hired 'Thai prostitutes' to retrieve money

Getty

In her testimony, Ellison recounted an occasion where Chinese regulators froze two of Alameda's trading accounts — which together held about $2 billion in assets — as part of an investigation into a person who had traded with the accounts.

Bankman-Fried and other members of Alameda's leadership tried several harebrained schemes to rescue the money, Ellison said.

In one plan they tried, they had "Thai prostitutes" make trades with Alameda's accounts in a way that would transfer the wealth over to them, where Alameda would then transfer it to themselves.

It didn't work, Ellison said.

After trying a few other ideas, Bankman-Fried authorized what Ellison believed was "a large bribe" that was "in the ballpark of $100 million" to officials in China.

The accounts were unlocked soon afterward, Ellison said.

10. Ellison admitted to Alameda employees that she was taking money from FTX customers

As FTX and Alameda were collapsing in November 2022, Ellison held an all-hands meeting with her staff at Alameda Research.

At the November 9 meeting — two days before Alameda and FTX filed for bankruptcy — Ellison said crypto prices were tanking, and Alameda couldn't repay loans that lenders were recalling. Then, she dropped the bomb that Alameda had taken funds from unknowing FTX customers.

"I was utterly shocked," testified Christian Drappi, a former Alameda software engineer who was present at the meeting in Alameda's Hong Kong office. He quit within 24 hours of the meeting.

Snippets of a recording of the meeting Drappi obtained were played for jurors in court.

Insider exclusively got ahold of an hour-long recording of the entire meeting, which you can listen to here.

11. Ellison felt relieved that it all came crashing down

Michael M. Santiago/Getty Images

When customers withdrew their funds en masse in November of 2022 — leading to the collapse of FTX and Alameda — Ellison said her "constant state of dread" was lifted. She no longer had to keep their theft a secret, she said.

"I felt a sense of relief that I didn't have to lie anymore, that I could start taking responsibility and being honest about what I had done," Ellison said. "Even though I obviously felt indescribably bad about all of the people that were harmed and the people that lost their money, the employees that lost their jobs, people that trusted us that we had betrayed."

Ellison said she confided in Bankman-Fried about her feelings of relief because she didn't feel like she had anyone else she could talk to about her feelings.

"I didn't feel I had anyone else to share it with because I had been trying to keep it secret for so long," she testified.

Read More

By: [email protected] (Katie Balevic,Jacob Shamsian)

Title: 11 of the biggest bombshells from Sam Bankman-Fried's FTX fraud trial

Sourced From: www.businessinsider.com/biggest-bombshells-sam-bankman-frieds-ftx-fraud-trial-2023-10

Published Date: Wed, 25 Oct 2023 19:50:12 +0000

.png)