Cindy Ord/Getty Images

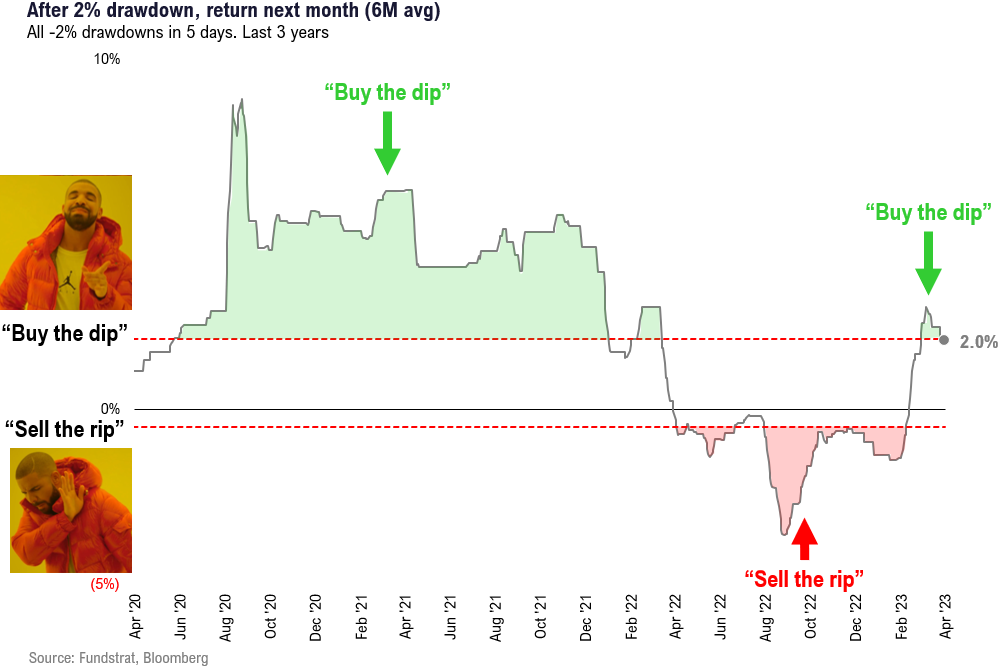

- The stock market has exited the "sell the rip" regime in favor of "buying the dip," according to Fundstrat's Tom Lee.

- That sets the S&P 500 up for a potential breakout above its 4,200 resistance level as investors worry about the debt ceiling.

- "This is creating a positive feedback loop, in the sense that capital invested on dips will recover losses quickly," Lee said.

The stock market's "sell the rip" regime that lasted for most of 2022 and into early 2023 has finally been reversed into a "buy the dip" regime, according to a Thursday note from Fundstrat's Tom Lee.

The bullish switch means the S&P 500 has a good chance of breaking above its key resistance level of 4,200 even as investors worry about the upcoming debt ceiling deadline.

Lee and his team of analysts identified the "sell the rip" regime as a period when stocks fall 2% in a week and fall further over the next 20 days. On the flip side, a "buy the dip" regime is identified as when stocks fall 2% in a week but recover the entire loss within 20 days.

Since 1928, it has paid to be invested in stocks during a "buy the dip" regime, which has occurred 60 times to deliver an average annualized gain of 28%. That pales in comparison to a "sell the rip" regime, which since 1928 occurred 30 times with an average annualized loss of 25%.

Luckily for investors, "buy the dip" returned to the stock market on March 23, according to Fundstrat, and that sets stocks up well for further gains.

"This is creating a positive feedback loop, in the sense that capital invested on dips will recover losses quickly. This was hardly the case in 2022, where for a 9-month period, every single dip of 2% was followed by an additional bout of selling," Lee explained.

The return of "buy the dip" adds to Lee's confidence that the S&P 500 will rise above its closely watched resistance level of 4,200.

"Still expecting an upside resolution towards S&P 500 4,200-plus," Lee said, adding that the risk of the debt ceiling is binary in nature. "A binary event is weighing on market risk-appetite at a time when there is little incoming macro data. Thus, markets are stuck in the near-term. That said, we see the rational for being overweight [stocks]."

Lee highlighted that the mega-cap tech stocks have positive leverage to the growing artificial intelligence opportunity, that regional banks are poised for a tactical rally, and that the S&P 500 sports a reasonable valuation when you exclude mega-cap tech stocks.

"We simply do not see equities as that expensive, especially with Fed on a 'pause.' Ex-FAANG, the forward P/E is 14.8x and the most expensive stocks are staples (~20x) and utilities (17x)," Lee said.

Lee reiterated his S&P 500 year-end price target of 4,750, which represents potential upside of about 14% from current levels.

Fundstrat

Read More

By: [email protected] (Matthew Fox)

Title: The stock market has flipped from 'sell the rip' to 'buy the dip,' and that should help push the S&P 500 above a key resistance level

Sourced From: markets.businessinsider.com/news/stocks/stock-market-outlook-buy-the-dip-sell-the-rip-regime-2023-5

Published Date: Thu, 18 May 2023 19:57:21 +0000

.png)