The weekend is here! Dan DeFrancesco in NYC.

Fun fact Friday: The only current member of the band ZZ Top who doesn't have a beard has the last name "Beard."

On tap, we've got stories on a pay bump for some junior bankers, FTX coming back from the dead, and how to get zen.

But first, let's play boar on the floor.

If this was forwarded to you, sign up here. Download Insider's app here.

HBO

1. Out with the old, in with the new?

The times they are-a-(potentially) changing on Wall Street.

Morgan Stanley CEO James Gorman confirmed what everyone already presumed: There are three executives in the running for his job.

Gorman did not specify which executives, but the writing is on the wall: Co-Presidents Ted Pick and Andy Saperstein and Dan Simkowitz, the head of investment management.

Gorman's comments got me thinking: Who else among the big-bank CEOs could be on their way out?

It turns out you could make the case for every top US bank making a change in leadership, either with or without the consent of their CEO.

Morgan Stanley

We'll start with Gorman since he's top of mind. At 64 years old, he's the second-oldest CEO among the big six US banks. When discussing succession plans with Bloomberg on Thursday, Gorman acknowledged he doesn't want this job forever. (To be fair, James, I don't think that was an option.)

"I will definitely step down. I am not going to stay in this job for life. I have no interest in that," he said.

And what better time than now to walk away? Morgan Stanley's wealth business is crushing it. In many ways it's the culmination of years of work by Gorman after leading the firm back from a near collapse during the financial crisis.

Another feather in Gorman's cap is the success of the bank's acquisitions under his watch. The purchase of Eaton Vance and E-Trade back in 2020 are looking smarter by the day. And even the boring stuff — like its acquisition of Solium Capital, which was renamed Shareworks by Morgan Stanley — is being copied by its peers.

JPMorgan

Jamie Dimon is another CEO whose succession plan has received plenty of speculation. There is arguably no finance executive in the world who has built up more goodwill than Dimon over the years.

However, the face of Wall Street recently took a hit over the bank's acquistion of the startup Frank, which has led to lawsuits from both sides. Dimon acknowledged the deal was a "huge mistake" but defended the firm's acquisition strategy, which has come under fire.

A $175 million deal gone bad is hardly a career-ender for Dimon. But it does raise questions about how long Dimon wants to remain at the helm. He's the oldest of the bank CEOs at 66 years old and had a health scare less than 3 years ago.

Bank of America

Brian Moynihan ticks several boxes that make his potential retirement a conversation worth having. He's spent more than a decade at the firm and can be credited with turning it around following the financial crisis. And at 63 years old, he's not exactly a spring chicken.

There's a case to be made for Moynihan to stay put. Unlike some of his peers, he's found success by avoiding big swings, instead pushing for "responsible growth," as he told Bloomberg.

Goldman Sachs

We've talked at length about how difficult of a run it's been for David Solomon recently. Solomon's biggest bet — turning Goldman into a Main Street powerhouse — has not panned out, to put it kindly. And while he's had wins, there's also been turmoil, including a decent amount of turnover in the highest ranks. Even Solomon's side hustle as a DJ, once viewed as a cool quirk of a bank exec, is starting to rub some insiders the wrong way.

At first glance Solomon's job doesn't appear to be in jeopardy, but 2023 is shaping up to be a massive year for how he'll be viewed as the bank continues to look to cut costs.

Wells Fargo

Charlie Scharf knew what he was getting into when he took over as CEO at Wells Fargo in 2019. Many of the problems he's grappled with are a not of his own doing. But that excuse only gets you so far.

Scharf's decision to shrink Wells footprint in mortgages feels like it could be a make-or-break moment. A successful pivot could be viewed as a masterstroke. But if the bank stumbles, it could be a death knell as the board gets fed up waiting for a turnaround that's long been promised but yet to be delivered.

Citigroup

As the newest CEO among the big six, this feels like the biggest stretch. Like Scharf, Jane Fraser adopted a bit of mess, including a $900 million blunder, from her predecessor Michael Corbat when she took over in 2021.

But Fraser's tenure thus far hasn't been spotless. One of her big initiatives — reorganizing the bank's wealth division — has already faced setbacks. And, unfortunately, it wouldn't be surprising to see Wall Street attempt to force out a woman executive prematurely.

In other news:

Christophe Gateau/picture alliance via Getty Images

2. It's baaaaaaaaack. FTX's new CEO hasn't given up hope on getting the bankrupt crypto exchange back up and running. More on what FTX 2.0 could look like.

3. You wanna take our guns? We'll take your bonds! The office of the Texas attorney general is limiting Citi's ability to underwrite the state's municipal bonds after it ruled the bank "discriminates against a firearm entity or firearm trade association," Bloomberg reports.

4. James Gorman <3 Elon Musk. The Morgan Stanley CEO said the billionaire is "one of the great entrepreneurs" of the last 100 years. More on why Gorman is all in on Musk.

5. And Jamie Dimon still doesn't like bitcoin. Meanwhile, the JPMorgan CEO continued one of his favorite pastimes: bashing crypto. He called bitcoin "hyped-up fraud" and said it's a "waste of time." Here's more of Dimon's thoughts on digital assets.

6. Citi's junior bankers get a bump. The bank raised comp for associates and vice presidents despite the dealmaking drought, Bloomberg reports. More on the unexpected raises.

7. Find out how much that Gucci bag of yours is worth. A leather expert deconstructs a $1,100 Gucci Dionysus leather mini bag to find out its true value. Check out the video.

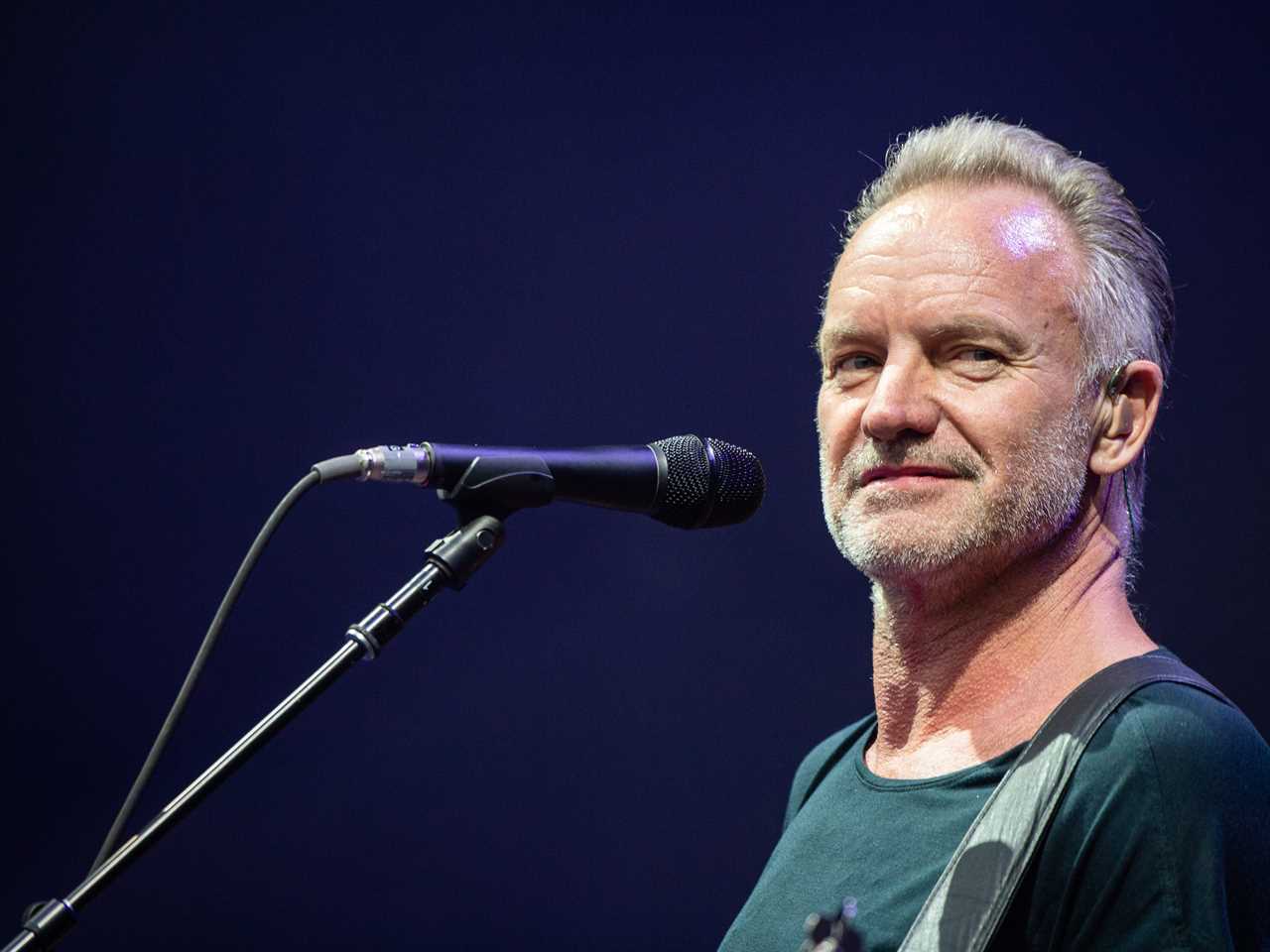

8. I'll be missing you, but I'm not missing this Sting concert. Microsoft executives enjoyed a private Sting performance at Davos the day before the tech giant announced layoffs impacting 10,000 employees. Who makes these decisions?

9. Forget F1, Netflix is about to turn everyone into a tennis fan. An exec at the streamer details why 'Break Point' can be as transformational for tennis as 'Drive to Survive' was for F1. More on sports at Netflix.

10. Let's get zen. If you've had trouble getting into meditating, perhaps these under-the-radar methods may help. From sound baths to moon gazing, here are 7 tips.

Curated by Dan DeFrancesco in New York. Feedback or tips? Email [email protected], tweet @dandefrancesco, or connect on LinkedIn. Edited by Jeffrey Cane (tweet @jeffrey_cane) in New York and Hallam Bullock (tweet @hallam_bullock) in London.

Read More

By: [email protected] (Dan DeFrancesco)

Title: Wall Street succession plans: The case for why all 6 big banks could consider a leadership change this year

Sourced From: www.businessinsider.com/wall-street-banks-succession-plans-goldman-sachs-jpmorgan-morgan-stanley-2023-1

Published Date: Fri, 20 Jan 2023 12:10:00 +0000

Did you miss our previous article...

https://trendinginbusiness.business/politcal/sam-bankmanfrieds-2-mysterious-bail-sponsors-ponied-up-a-total-of-700000-to-get-the-alleged-fraudster-out-of-jail

.png)