Loan repurchases continue to trend downward at both Fannie Mae and Freddie Mac, but there appears to be a separation developing in loan-repurchase patterns — with Freddie reducing its loan buybacks at a faster clip than Fannie, according to recently released data and public filings.

The volume of loan repurchases at both Fannie and Freddie is down significantly since the peak in the second quarter (Q2) of 2022, with the steepest volume decline occurring over the final six months of 2023 (the most recent data available), according to assessments conducted by two separate mortgage-analytics firms.

Between Q2 2023 through Q4 2023, however, Freddie’s total loan-repurchase dollar volume dropped at a significantly greater pace than did Fannie’s volume.

Over the period, for Freddie, repurchase volume declined by 54% (from $594 million to $276 million), compared with only a 21% decline (from $444 million to $349 million) for Fannie, according to an analysis of the agency’s most recently released loan-level data by Brett Ludden, managing director and co-head of the financial services team at Sterling Point Advisors, a merger and acquisitions advisory firm. Ludden also is the co-founder and managing partner of Augment Analytics.

“There’s no indication, at least for data through the fourth quarter of 2023, that Fannie is doing anything to address this issue that pretty much for the past two years has been one of the number one issues lenders have been raising to the GSEs [government-sponsored enterprises],” Ludden said.

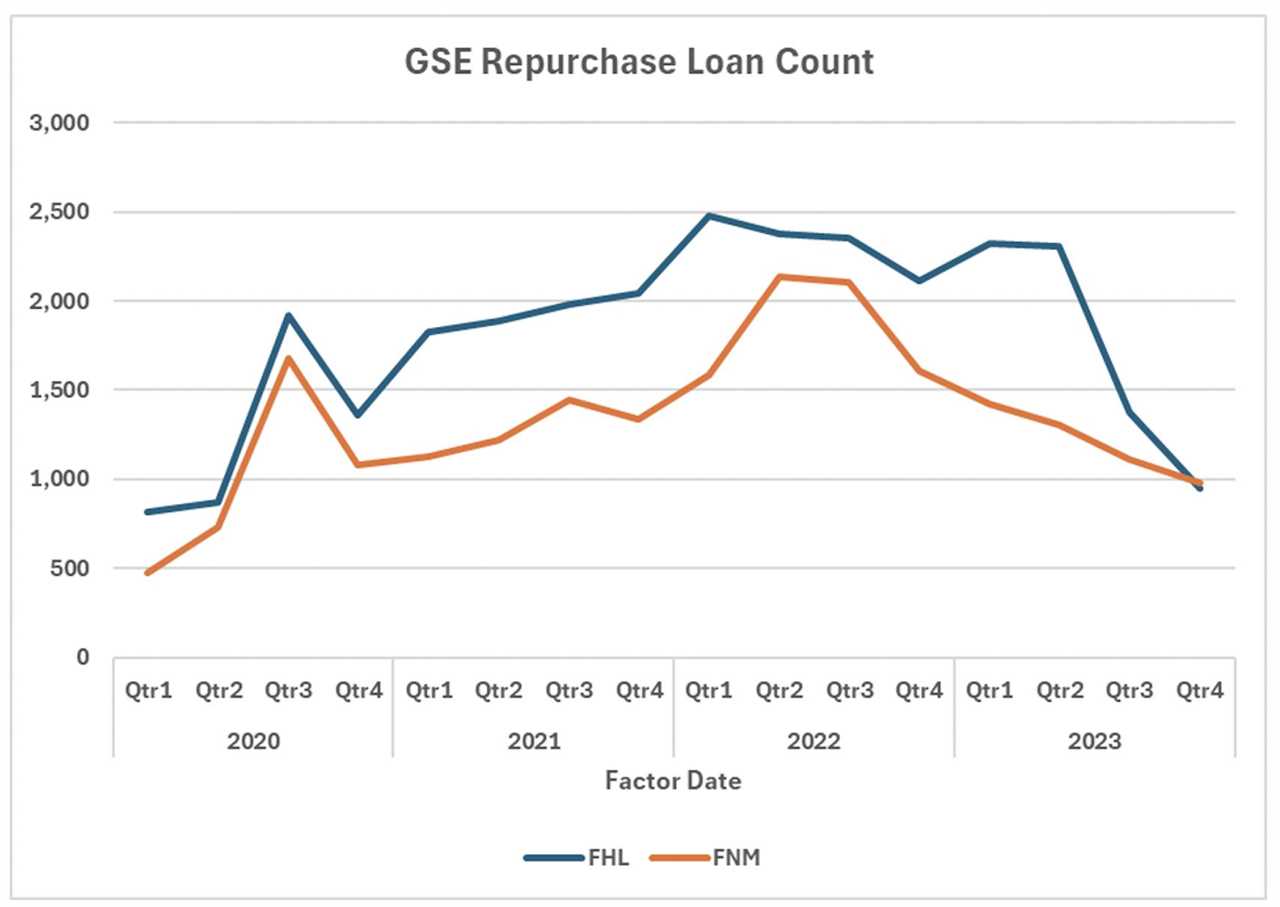

A review of the same agency loan-level data by mortgage-analytics firm Recursion shows that Freddie Mac’s repurchase-loan count, as of the first quarter of 2022, stood at about 2,500 loans, compared to about 1,500 repurchased loans for Fannie Mae. As of the fourth quarter of last year, however, that gap had all but disappeared, with each agency repurchasing about 1,000 loans each.

“[Freddie] has come way down [in its loan-repurchase count], and now they’re about the same [as Fannie], and that’s really interesting,” said Richard Koss, chief research officer at Recursion

In response to the analyses by Recursion and Sterling Point’s Ludden, a Fannie Mae spokesperson provided the following comment via email:

“We cannot validate this third-party analysis. As noted in our 2023 Form 10-K [filed with the U.S. Securities and Exchange Commission, or SEC] for loans delivered in the 12-month period ending May 31, 2023, the dollar amount of loan repurchase requests issued declined by approximately 42% compared to the prior 12-month period.”

Breaking it down

There was a total of $335.6 million in repurchase requests issued for the 12 months ending May 31, 2022, according to figures provided in Fannie’s SEC filing, and there was a total of $194.2 million in repurchase requests issued for the same period in 2023. That does represent a 42% decrease in the dollar volume of loan requests year over year.

Fannie’s loan-repurchase request rate, however, is another matter. It increased over the two 12-month periods being compared — from 0.32% of total loans delivered to 0.51% of loans delivered. The percentages are based on repurchase requests issued as of yearend on loans delivered during the 12-month periods ending May 31 in 2022 and 2023.

Loans delivered to Fannie also decreased substantially over the 12-month periods compared, from nearly $1.1 trillion down to $381 billion, Fannie’s SEC filing (page 81) shows.

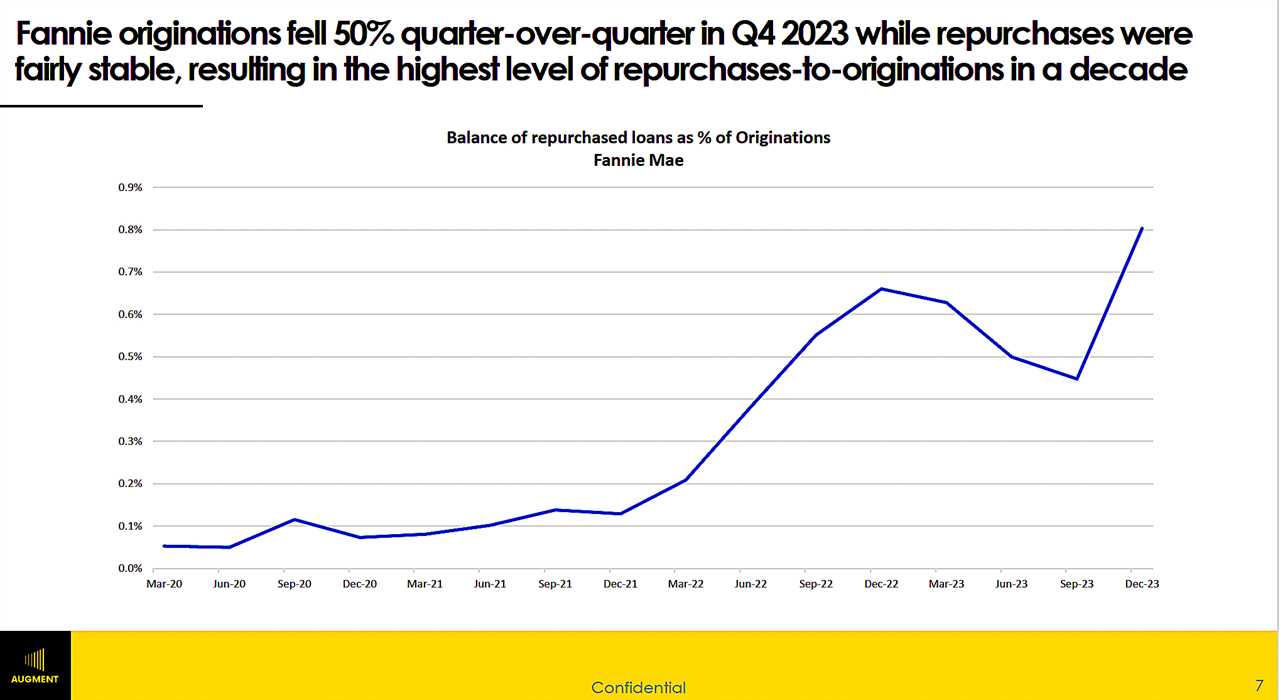

Current-quarter repurchase demands involve loans outstanding that were originated in prior quarters, so there is lag time between loan originations and repurchase demands, if any, on those loans. To get an idea of the loan-repurchase impact felt by mortgage originators at ground level, however, Ludden examined lender repurchases of Fannie loans as a percentage of new originations in the same quarter.

“Lenders repurchased one Fannie Mae loan for every 125 loans that they originated in the fourth quarter of 2023, for a 0.8% repurchase rate,” he said, adding that it’s the highest level of repurchases to originations in at least a decade. “That helps you gauge the impact lenders are feeling as they’re originating loans and loans are coming back at them.”

Comparable figures on loan-repurchase rates were not available in Freddie’s most recent 10-K SEC filing (its 2023 annual report), nor did Freddie officials reply to a request for comment. The agencies SEC filing does note on page 74, however, that the dollar volume of total “repurchase requests” is down substantially.

“As of December 31, 2023, and December 31, 2022, the UPB [unpaid principal balance] of loans subject to repurchase requests issued to our single-family sellers and servicers [versus loans actually repurchased] was approximately $0.5 billion [$500 million] and $1.3 billion, respectively,” Freddie’s SEC filing states.

Directionally positive

Pete Mills, senior vice president of residential policy and strategic industry engagement at the Mortgage Bankers Association (MBA), stresses that the loan-buyback patterns at both agencies are improving. In addition, Mills said efforts are underway at both agencies to continue that trend.

“[Freddie has done] significant things around the second-review process before a repurchase demand goes out,” Mills said. “… Now they’ve got an entirely new pilot program.

“We don’t have the results on that yet, but that was an effort to rethink the process, and we’re very interested in seeing member feedback on that.”

The Freddie pilot utilizes a fee-based system designed to reward lenders that deliver high-quality loans. The new program was rolled out in the final quarter of 2023 and involves some 12-15 lenders representing a cross-section of the mortgage industry.

“Specifically, lenders will not be subject to repurchases on most performing loans and will instead be subject to a fee-based structure based on non-acceptable quality (NAQ) rates,” Freddie’s description of the pilot program states. “The fee will apply uniformly to medium and large lenders based on NAQ rates and will be waived for smaller lenders that do not deliver a large enough volume to generate a statistically significant NAQ rate.

“Loans that are non-performing within 36 months or subject to life-of-loan defects will still be subject to repurchase.”

Thomas Booker is chief strategy officer at Candor Technology, a fintech firm that offers clients an automated mortgage-underwriting service that includes a focus on credit and information risk-assessment.

“My bet is Fannie Mae will do something similar [to Fannie’s pilot] in the future in an effort to try to mitigate the exposure to this multi-year contingent liability [loan repurchases],” Candor said. “I think that’s really a big exposure.”

Mills said Fannie has taken some positive steps on the loan-repurchase front. For example, he said, “Rather than draft the repurchase request, they will go out with a Notice of Potential Defect that [indicates] there might be a problem with this loan” and then ask a lender to “supplement documentation or to respond” to the notice.

“Fannie has also put a lot of stock in trying to move people [lenders] to their technology that will essentially provide more day-one certainty aspects that will reduce the likelihood of a repurchase demand,” Mills added. “… This whole process, in many cases, comes down to individual judgments about things about which people can disagree.

“So, the noise will never go away. … But I think certainly directionally, the progress [at both agencies] has been positive,” he said.

The Fannie Mae spokesperson stressed that the agency “continues to work with lenders and industry trade groups to improve loan-manufacturing quality and address feedback in the repurchase process.”

“… Fannie Mae is committed to providing lenders with products and services, like our recently released self-employed income calculator and our DU Validation Service-Single Source solution, that help prevent loan-manufacturing errors from occurring in the first place.”

The nature of the defect that drives many repurchases is often a missing document, not a poor calculation,” Candor’s Booker explained.

“And there’s systemic approaches that I think both agencies are taking that will reduce repurchases,” he added. “… The incentives to reduce defects are substantial, and part of what you’re going to see going forward is more and more [quality-control] activities at the front end of the business.”

Transparency needed

Still, the loan-repurchase data released by both agencies is dated, incomplete and hard to compare on an apples-to-apples basis, so there is a real need for more loan-repurchase data transparency from both Fannie Mae and Freddie Mac, industry sources argue.

“If they would expand their loan-level data set to include pending repurchase demands, we would be able to more explicitly confirm what they [the agencies] are saying,” Ludden said. “But because they don’t [release such data], it means that we are always operating on a massive delay.”

MBA’s Mills agrees that greater transparency from both agencies would be a plus for the mortgage industry. He said having the Federal Housing Finance Agency (FHFA), which oversees Fannie and Freddie, release regular, comprehensive, “consistent [loan-repurchase] data reported the same way” for both agencies “for the market writ large to evaluate the repurchase issue” would “make sense.”

“If you’re just looking at the volume of [actual] repurchases, but you don’t look at the number of loans reviewed … you need both parts,” Mills added. “You need to align the year and quarter that the loans were originated and when the [repurchase review] was done.

“You have to align those things, otherwise you get skewed data, particularly when [loan] volumes are increasing quickly or decreasing quickly.”

Brian Hale, founder and CEO of consulting firm Mortgage Advisory Partners, added that financially right now, “it is still one of the worst times for the mortgage industry, and people are worn out.”

“… If you’re a smart person running and driving repurchases [at one of the agencies], it’s in your best interest to make sure that your demands are legitimate, pragmatic and reasonable,” Hale added. “There’s a dynamic, or a continuum, between how many times do I punch you in the face [with a loan-repurchase demand] and then ask for your volume.

… I can put 90% of my customers out of business, I suppose, if I want to, but I’m not sure how that provides a business for me to run into the future…. You can’t show up and stab the wounded.”

------------Read More

By: Bill Conroy

Title: Analysis: Loan repurchase patterns at Fannie, Freddie are divergent

Sourced From: www.housingwire.com/articles/analysis-loan-repurchase-patterns-at-fannie-freddie-are-divergent/

Published Date: Wed, 05 Jun 2024 15:07:48 +0000

Did you miss our previous article...

https://trendinginbusiness.business/real-estate/a-foxshaped-tree-house-came-to-her-in-a-dream-so-she-and-her-husband-spent-years-building-it

.png)