Welcome to the exciting world of homeownership in Texas. Whether you’re a first-time homebuyer or an experienced real estate investor, buying a home in the Lone Star State is a thrilling experience. Texas is renowned for its warm and welcoming communities, rich cultural diversity, and thriving economy that provides endless opportunities for growth and prosperity. With a wide range of housing options, from spacious suburban homes to beautiful city condos and charming rural properties, there is something for every lifestyle.

If you’re ready to embark on a journey toward homeownership, Redfin is here to help. With the proper guidance and research, you’ll be a Texas homeowner in no time.

What’s it like to live in Texas?

Living in Texas is a unique and exciting experience that offers a perfect blend of warm hospitality, rich cultural diversity, and thriving economic opportunities. The state is known for its friendly people, who welcome newcomers with open arms and make them feel at home. Residents can enjoy a dynamic urban lifestyle with world-class entertainment, cultural events, and excellent dining options. Texas also boasts beautiful natural landscapes, such as the Hill Country, Big Bend National Park, and Gulf Coast beaches, providing ample opportunities for outdoor recreation. Check out this article to learn more about the pros and cons of living in Texas.

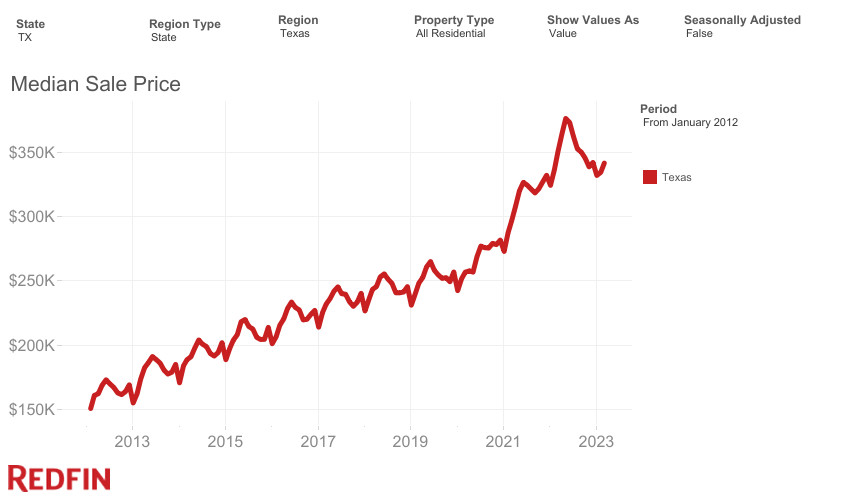

An overview of the Texas housing market

The Texas housing market is rich in diversity, with plenty of options to suit different budgets and lifestyles. Due to the state’s thriving economy, low cost of living, and a growing population, Texas has become a magnet for buyers and investors, which has resulted in median sale prices climbing steadily in recent years. However, due to the recent hike in mortgage rates, the market has experienced a slight decline, with median sale prices dropping by 2.5% to $341,300 and competition slowing down. Nonetheless, it’s worth noting that Dallas and Houston continue to be among the top 10 places homebuyers move to when relocating.

Finding your perfect location in Texas

When deciding where to live in Texas, there are so many great cities, neighborhoods, and communities to choose from. To make an informed decision, you’ll want to consider proximity to work/school, access to public transportation, parks, restaurants, and shopping centers. Location is also crucial to your property’s resale value and appreciation potential.

To help you get started, here are some of the most popular cities in Texas, including market insights. And if you find your interest between two cities, fear not. Tools like a cost of living calculator can help you find a city within your budget.

#1: Austin, TX

Median home price: $535,000

Austin, TX homes for sale

Welcome to the charming city of Austin, also known as the “Live Music Capital of the World. This vibrant and creative city celebrates its cultural roots with a unique blend of big-city amenities and small-town charm. With its laid-back and welcoming atmosphere, living in Austin is an experience like no other.

You’ll fall in love with Austin’s thriving tech industry, world-class universities, breathtaking parks, and expansive lakes like Lake Travis and Lady Bird Lake. Though the city’s popularity has led to some challenges, such as rising housing costs and traffic, don’t worry. Austin still has plenty of charming, affordable suburbs to explore and call home.

#2: Dallas, TX

Median home price: $384,990

Dallas, TX homes for sale

Living in Dallas offers a unique blend of big-city amenities and Southern charm. Known as the “Big D,” Dallas is a bustling metropolis offering diverse neighborhoods, from trendy urban areas to affordable suburbs. The city boasts world-class museums such as the Dallas Museum of Art, which is one of the largest art museums in the country, and historic theaters like the Majestic Theatre which hosts a variety of performances including concerts and comedy acts.

Additionally, Dallas has a lively sports scene that includes professional football teams like the Dallas Cowboys, basketball teams such as the Dallas Mavericks, baseball teams such as the Texas Rangers, and soccer teams like FC Dallas. If you’re a sports enthusiast, Dallas may be the perfect city for you to cheer for.

#3: Houston, TX

Median home price: $330,000

Houston, TX homes for sale

Living in Houston offers an abundance of activities to explore, from indulging in the local food scene to immersing oneself in the city’s cultural events. The annual Houston Livestock Show and Rodeo is a must-see, drawing millions of visitors as the largest rodeo in the world. And for sports lovers, rooting for the Houston Astros and Houston Rockets is a must if you’re in town. Houston also boasts a thriving economy and a low cost of living, 9% less expensive compared to Austin, to be exact. Although the closer to downtown you are, the housing prices will go up, so if you’re looking to stay within budget, consider these affordable Houston suburbs.

#4: San Antonio, TX

Median home price: $274,383

San Antonio, TX homes for sale

San Antonio, a city rich in Texan heritage, boasts of historical landmarks like the iconic Alamo and festivals like the Fiesta San Antonio that pay homage to its past. The city’s vibrant food scene is a must-try, featuring Tex-Mex cuisine and local delicacies like barbacoa and breakfast tacos. The warm climate and various outdoor recreational activities such as hiking, fishing, and water sports make great reasons to move to San Antonio. To learn more about the charming neighborhoods in the city, check out this article on the most affordable San Antonio suburbs.

#5: Fort Worth, TX

Median home price: $335,000

Fort Worth, TX homes for sale

Fort Worth is an attractive option for families and young professionals due to its lower cost of living compared to other popular cities in Texas. With a cost of living 7% lower than Dallas, it’s easy to see why people are drawn to the city. Additionally, there are several affordable suburbs that offer a high quality of life, excellent schools, and easy access to the city’s amenities. If you’re new to living in Fort Worth, exploring the different districts is highly recommended. Start with the Fort Worth Stockyards, a historic district that celebrates the cattle industry with rodeos, cattle drives, and western-themed shops. Then, head over to the Fort Worth Cultural District, which features several museums such as the Kimbell Art Museum and the Amon Carter Museum of American Art. With so much to explore, Fort Worth is a charming city that is sure to leave a lasting impression.

To learn more about popular Texas cities, check out this article on the fastest-growing cities in Texas.

The homebuying process in Texas

If you have your heart set on Texas as your state of choice and have pinpointed your desired location, it’s time to explore buying a home in that area.

1. Get your finances together

Getting your finances in order before purchasing a home in Texas is crucial to ensure a smooth and successful homebuying experience. Buying a home is a significant financial commitment, and it’s essential to clearly understand your current financial situation. This includes checking your credit score, saving for a down payment, and calculating your monthly expenses to determine a realistic budget for mortgage payments. Tools like an affordability calculator can also guide you in the right direction. By getting your finances together, you can set yourself up for success and make your dream of homeownership in Texas a reality.

There are various programs available for first-time homebuyers in Texas, including the TDHCA: My First Texas Home, which can assist with a down payment of up to 5% of the loan amount. Acquiring knowledge about these programs can significantly enhance your home purchasing journey.

2. Get pre-approved from a lender

One of the most important steps you can do for yourself is to get pre-approved for a mortgage loan. This involves submitting a mortgage application to a lender, who will review your financial history, credit score, and other factors to determine how much they are willing to lend you for a home purchase. By obtaining pre-approval, you can get a clear idea of your budget for home shopping and make more informed decisions about which properties to consider.

3. Connect with a local agent in Texas

Working with a local Texan real estate agent is a must when buying a house in Texas. Texas is a large state with diverse housing markets, and local agents have extensive knowledge about their specific area’s real estate market, trends, and neighborhood information. Whether you’re working with a real estate agent in Austin or an agent in Houston, they can provide valuable insights on specific areas that fit your lifestyle and preferences, such as schools, amenities, and commute times. Additionally, local real estate agents can help you navigate the complex homebuying process in Texas, including property search, offer negotiation, and closing.

4. Search for homes

When touring homes in Texas, there are several key things to look for. First, pay attention to the home’s overall condition, including the roof, foundation, and major systems like heating and cooling. Additionally, check for any signs of damage, such as water stains, cracks, or leaks. It’s also important to consider the layout and functionality of the home, including the number and size of bedrooms, bathrooms, and living spaces. By considering these factors when touring homes in Texas, you can make an informed decision and find the perfect home for you.

5. Make an offer

Several factors come into play when making an offer on a home in Texas. The offer includes the purchase price you are willing to pay, any contingencies or conditions of the sale, and the proposed timeline for closing the transaction. Additionally, you may include an earnest money deposit to show your commitment to the purchase. The offer will also specify the closing date, typically 30-45 days after the offer is accepted. The seller will review the offer and decide whether to accept, reject, or counter the terms proposed. By crafting a strong offer, you increase your chances of success in the homebuying process in Texas.

6. Close on the house

The closing is a crucial step in the homebuying process in Texas, where the final transfer of ownership occurs, and you become the legal owner of the property. During the closing, you will sign all the necessary paperwork, pay the closing costs, and receive the keys to your new home. It’s essential to review all documents carefully, including the settlement statement and loan documents, to ensure that all terms and conditions are correct before signing. The closing is also an opportunity to ask any final questions and clarify any concerns you may have before finalizing the purchase.

If you are a first-time homebuyer, Redfin’s comprehensive First-Time Homebuyer Guide can be an invaluable resource to help you gain a deeper understanding of the entire homebuying process.

Factors to consider when purchasing in Texas

It’s essential to remember the unique aspects of purchasing a property in Texas, such as available loan types, taxes, insurance, and disclosures.

The climate in Texas can be extreme

Before purchasing a house in Texas, it’s important to take the state’s climate risk and weather into account. The weather in Texas is characterized by high temperatures and humidity, particularly in the summer season. On average, utility costs in Texas come to $402, which is why it’s advisable to opt for energy-efficient windows, insulation, and air conditioning systems to keep your home cool and reduce energy expenditure.

Texas is also prone to severe weather events such as tornadoes, hurricanes, and hailstorms, which can cause significant damage to homes. It’s essential to factor in climate risk and the potential cost of repairs and insurance coverage to protect your investment.

Dual Agency is not permitted

Dual agency is not allowed in Texas when one real estate agent represents both the buyer and the seller in a transaction. The state follows the principle of “agency,” which means that a real estate agent must represent either the buyer or the seller exclusively and not both. This is because the interests of the buyer and seller can often conflict, and each party must have representation. In Texas, real estate agents must disclose their agency relationships and provide a written agreement outlining their responsibilities to their clients.

Seller disclosures are required

In Texas, seller disclosures are required when buying a house. This means that the seller must legally disclose any known defects or issues with the property to the buyer before the sale is finalized. The Texas Real Estate Commission provides a standard form for seller disclosures, which covers the property’s condition, past repairs or renovations, known environmental hazards, and any outstanding liens or easements. It’s important for buyers to carefully review these disclosures before finalizing the sale, as they can provide critical information about the condition of the property and any potential issues that may need to be addressed.

Homestead exemption

The Homestead Exemption program provides a tax break to homeowners on their primary residence in Texas. It works by reducing the property’s taxable value, which in turn lowers the property taxes that the homeowner must pay. To be eligible for the Homestead Exemption, the homeowner must have owned and occupied the property as their primary residence on January 1st of the tax year. They must also apply with their local county appraisal district to claim the exemption. In addition to providing tax relief, the Homestead Exemption also offers some protection to homeowners by limiting the amount their property taxes can increase yearly.

Property taxes are high

Texas holds the sixth position in the country for having high property taxes. Local government entities set the rates, which vary widely depending on the property’s location. According to recent data, Texas has one of the highest property tax rates in the country, with an average rate of around 1.74% of the home’s assessed value. This can add up to a substantial expense for homeowners, especially those with higher-priced homes. However, it’s important to note that Texas does not have a state income tax, which can offset some of the impacts of the property tax rates.

Buying a house in Texas: Bottom line

Buying a house in Texas can be an exciting and rewarding experience. However, it’s essential to be prepared and informed about the unique aspects of the homebuying process in the Lone Star State. From considering the climate and location to working with a local real estate agent and getting pre-approved, there are many factors to consider when embarking on this journey. Additionally, with Texas having one of the highest property tax rates in the country, it’s crucial to factor this into your budget and explore any available tax relief programs. By taking these steps, you can increase your chances of finding the perfect home in Texas and making your homeownership dreams a reality.

Buying a house in Texas FAQ

How much income do you need to buy a house in Texas

The amount of income you need to buy a house in Texas can vary depending on several factors, such as the location, home price, down payment, credit score, and debt-to-income ratio. In general, lenders usually recommend that your monthly housing expenses, including mortgage payments, property taxes, and insurance, should not exceed 28% to 36% of your gross monthly income. For example, if you earn a monthly gross income of $6,000, your recommended maximum housing expenses would be between $1,680 and $2,160. However, it’s important to note that these are just general guidelines, and you should consult a lender to determine your specific affordability and financing options.

Is buying property in Texas worth it?

Whether buying property in Texas is worth it depends on individual circumstances and preferences. However, Texas is generally considered a great place to invest in real estate due to its growing economy, population, and job market. Texas also has relatively affordable home prices compared to many other states, although property taxes can be high. Buying property in Texas can be a wise investment, but it’s important to consider factors such as location, financing options, and long-term goals before deciding.

How much deposit is needed to buy a house in Texas?

The deposit amount needed to buy a house in Texas can vary depending on the lender and the type of loan. Generally, a down payment of at least 3% to 20% of the home’s purchase price is required. For example, if you buy a $250,000 home, a down payment of $7,500 to $50,000 would be needed. However, some first-time homebuyer programs in Texas offer down payment assistance, which can lower the required money upfront. Working with a lender and a real estate agent is essential to determine the specific deposit requirements for your situation.

The post The Ultimate Guide to Buying a House in Texas appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.

------------Read More

By: Ana de Guzman

Title: The Ultimate Guide to Buying a House in Texas

Sourced From: www.redfin.com/blog/buying-a-house-in-texas/

Published Date: Fri, 05 May 2023 18:12:45 +0000

.png)