The cost of home insurance in the United States rose by ~89% between 2014 and 2025, as rapidly climbing home prices, more frequent extreme weather events and inflation impacted insurers and homeowners. ICE analysts share key insights from their recent 10-year study into the forces propelling rising insurance costs across the nation.

Over the past decade, home insurance costs have risen rapidly in many parts of the United States. This has been driven by numerous factors, including an increase in the costs associated with extreme weather events, the COVID-era spike in nationwide housing values, and high inflation in 2021-22.

Before 2017, the five-year rolling average costs associated with billion-dollar disaster events was consistently less than $100 billion in the U.S. Since 2017, however, those costs have consistently exceeded $120 billion.

Increasing costs due to extreme weather events will likely continue since these events are projected to become more frequent and severe, creating mounting cost pressures for federal, state, and local governments, as well as insurance companies and homeowners.

In some parts of the nation, rising insurance costs are already contributing to home affordability challenges. For homeowners with mortgages, insurance is an unavoidable cost as lenders require basic home insurance, while homeowners in high flood risk areas face even higher costs because lenders require them to hold additional flood insurance.

Premiums are also tied to the amount of coverage (often set by the value of the home) and over the past five years, home values, as well as construction and replacement costs, have risen across the country. Between March 2020 and January 2023, ICE’s nationwide Single Family Home Price Index increased by nearly 36%.

As home values increase, the amount of insurance coverage purchased generally also increases — leading to a rise in premiums even if all other factors remain constant. High inflationover the past few years has also contributed to an increase in the dollar amount of insurance premiums paid across the country.

Rising insurance costs are likely to have broad effects on the U.S. housing and mortgage market. Home values may be impacted as fewer prospective homebuyers are able to afford the insurance they need to obtain a mortgage, and home value declines could prove disruptive for local governments that depend heavily on property taxes.

Because these impacts are interconnected, insurance cost increases will affect every participant and stakeholder in the U.S. real estate market. This means it is critical to understand trends in insurance costs across the country.

To tease out the contributions of these different factors, ICE examined insurance costs from more than 18 million single family loans in the ICE McDash data set, which contains anonymized data on residential loans in the U.S. back to 2013.

The analysis finds that insurance costs rose across the board during that time, but those cost increases vary between different loan cohorts.

Insurance costs for all active loans: Looking at the broadest view of insurance cost increases — the 12 million single-family loans active in 2014 and 18 million active loans in 2025 — ICE data reveals the average total insurance cost for these loans has climbed from $1,270 in 2014 to $2,405 by 2025 (+89%). Cost changes vary significantly depending on location.

Figure 1. Average total insurance costs for all active single-family loans in the ICE McDash data set by county in 2014 and 2025. Source: ICE McDash as of 9/01/2025.

Insurance costs for continuously existing loans:

Continuously existing loans are associated with established homeowners. Unless dropped by an insurance carrier, these households are not likely to shop for cheaper or better policies each year. For the two million loans in the ICE McDash data set that existed continuously between December 2014 and August 2025, average total insurance costs almost doubled from $1,230 in 2014 to $2,440 by 2025 (+98%).

Insurance costs for loans originated in each year:

Homebuyers associated with newly originated loans are likely to have been engaged in insurance policy selection in that year. In the ICE McDash data set, 950,000 loans were originated in 2014, with one million loans originated in 2024. The average total insurance cost for 2014 loans was about $1,150, but by 2024, it had climbed to $1,950 — significantly lower than the increase in cost for continuously existing loans, which was +69% higher in 2025 than in 2014.

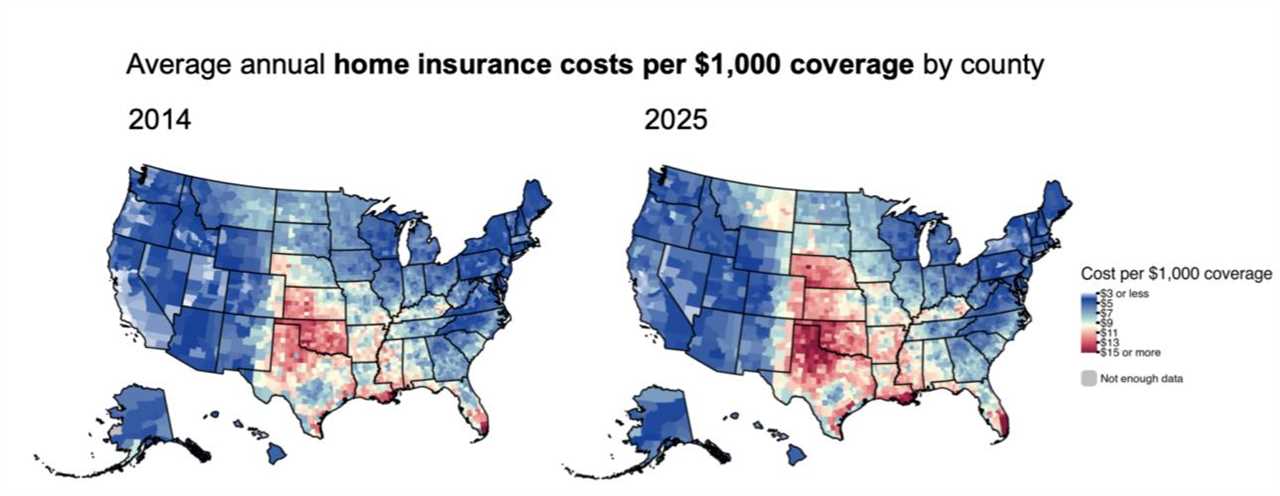

Cost per $1,000 of coverage

Inflation and coverage amount changes have been major contributing factors to increasing insurance costs between 2014 and 2025. As a ratio, insurance cost per $1,000 of coverage provides a perspective on these costs that accounts for both inflation and coverage amount changes.

Figure 2. Average total hazard insurance costs per $1,000 coverage for all active single-family loans in the ICE McDash data set by county in 2014 and 2025. Source: ICE McDash as of 9/01/2025.

Comparing costs per $1,000 of coverage for continuously existing and newly originated loans reveals an interesting insight: loans that were continuously in existence from 2014 to 2025 have higher average costs than newly originated loans every year. This pattern suggests that by actively engaging in insurance policy and deductible selection — as new homebuyers tend to do — many homeowners with longstanding loans could significantly reduce their insurance costs.

Figure 3. Average hazard insurance costs per $1,000 of coverage over time for three loan cross-sections. Source: ICE McDash as of 9/01/2025.

To request access to the complete 10-year analysis How are insurance costs changing for U.S. homeowners? A visual perspective, please click here.

------------Read More

By: Intercontinental Exchange Inc.

Title: Why U.S. home insurance costs have leapt in the past decade

Sourced From: www.housingwire.com/articles/why-u-s-home-insurance-costs-have-leapt-in-the-past-decade/

Published Date: Tue, 09 Dec 2025 09:15:00 +0000

.png)