To try out Rocket Money today and unlock more features with premium, head to: https://rocketmoney.com/graham - Enjoy! Let's talk about Investing in 2026, my thoughts on Stocks, Real Estate, and Cryptocurrency, and what this means for you - Enjoy! Add me on Instagram: GPStephan

2026: FINANCIAL TURNING PINT

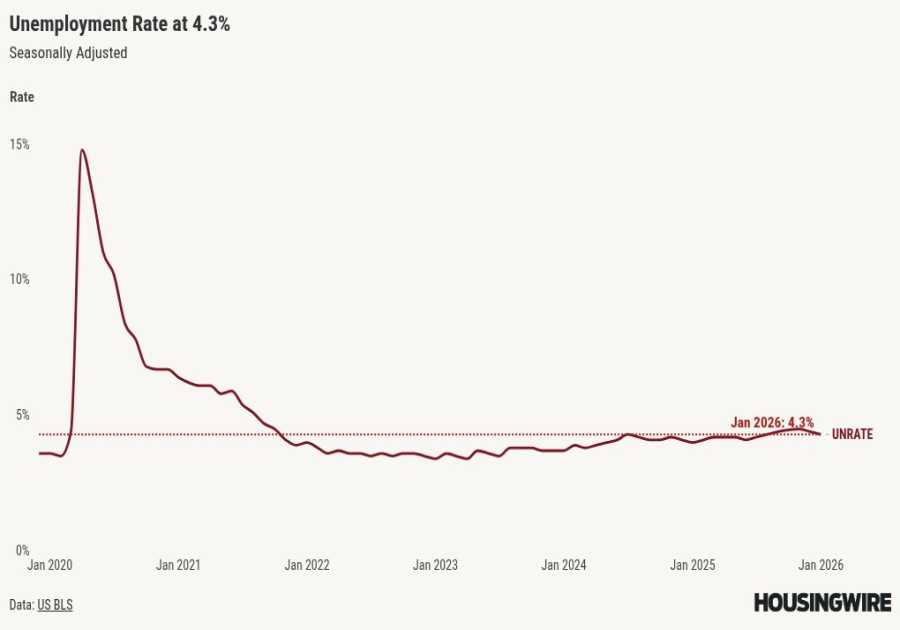

This year is shaping up to be one of the most contradictory financial periods in recent history. Despite over half of Americans saying they don’t have enough money to invest, stocks are near all-time highs, AI valuations are raising bubble concerns, and housing affordability is the worst it’s been in decades.

Unprecedented Market Conditions

For the first time in years, the Federal Reserve has resumed money expansion while insiders are selling stocks at the fastest pace since 2021. At the same time, nearly every asset class (stocks, real estate, crypto, and precious metals) is trading at historically expensive levels. This creates an environment where prices can continue rising, but volatility and sharp corrections become far more likely.

Stock Market Strategy: Simplicity Over Prediction

Rather than attempting to time the market, the focus remains on broad diversification through index funds. A mix of U.S. broad-market equities, international stocks, and emerging markets provides exposure to global growth while minimizing complexity. Dollar-cost averaging (especially during downturns) has proven effective, even when it temporarily results in large paper losses. Over long timeframes, consistency has historically beaten market timing.

Market Uncertainty & Long-Term Discipline

Short-term market direction remains unknowable. Rate cuts, AI speculation, and macro shocks could push markets higher or trigger selloffs. However, history shows that markets often behave irrationally longer than investors expect. For anyone with a long investment horizon, staying invested and ignoring noise has consistently outperformed reactive strategies.

Exiting Real Estate: ROI vs Peace of Mind

Real estate no longer offers the same risk-adjusted returns it once did, especially in high-cost states. Monthly payments have doubled over five years, renting is often cheaper than buying, and regulatory and maintenance burdens continue rising. While real estate can still work for active investors hunting deals, selling properties now allows capital to be redeployed into more passive, flexible investments.

Bitcoin: Volatility With Long-Term Optionality

Bitcoin experienced extreme swings throughout the year, making it one of the weakest short-term performers despite strong long-term narratives. Leverage liquidations, profit-taking, and risk-off rotations contributed to declines. A smaller portfolio allocation acknowledges both the upside potential and the significant volatility, while dollar-cost averaging and tax-loss harvesting help manage risk.

Precious Metals: Strong Performance, Mixed Outlook

Gold, silver, and platinum have surged to record or near-record levels, driven by industrial demand, supply constraints, and economic uncertainty. Silver, in particular, benefits from real industrial shortages, though inflation-adjusted prices remain below historical peaks. While metals can hedge uncertainty, long-term growth expectations still favor equities.

Treasuries & Cash: The Stability Buffer

Holding a meaningful allocation to treasuries and municipal bonds provides steady income and optionality. While this limits upside compared to being fully invested in equities, it offers liquidity and peace of mind—especially during downturns—allowing capital to be deployed when opportunities arise.

Overall 2026 Outlook

Rather than a single asset exploding or collapsing, 2026 is likely to bring lower, choppier returns with higher volatility. Easy gains may be behind us. The market will reward patience, diversification, and emotional discipline, while punishing leverage, speculation, and short-term thinking.

Core Strategy Moving Forward

Buy consistently.

Stay diversified.

Protect downside risk.

Ignore headlines.

Let time do the heavy lifting.

GET MY WEEKLY EMAIL MARKET RECAP NEWSLETTER: http://grahamstephan.com/newsletter

My ENTIRE Camera and Recording Equipment:

https://www.amazon.com/shop/grahamstephan?listId=2TNWZ7RP1P1EB

For business inquiries, you can reach me at [email protected]

*Some of the links and other products that appear on this video are from companies which Graham Stephan will earn an affiliate commission or referral bonus. Graham Stephan is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. This is not investment advice.

.png)